Faculty of Business, Jeddah University, Al-Kamel Governorate Branch- Jeddah, Saudi Arabia

Corresponding author Email: smyounis@uj.edu.sa

Article Publishing History

Received: 12/11/2018

Accepted After Revision: 29/12/2018

Recognize the contributions of physical capital, human capital, and the rest of the other factors in the process of economic growth, according to an expanded approach of growth accounting. The study covered the period from (1970-2008) depending on annual data for the variables of this study. The gross fixed capital formation is used as an indicator of physical capital, and one of the objectives to reach a suitable estimate of the human capital that used in the analysis. Calculation the work item index and average wages using data on years of education, and the return from Education (intended here wages received by the worker). This method determining the weights of the various levels of educational attainment based on the rate of return, which received from the education, and the element of the adjusted Labor of human capital (or wages). The human capital is an index measuring the contribution of the skilled work rate element which is very good at the distribution of education gained by the country. The human capital is best measured by average years of schooling of the workforce. The study Applied the co-integration approach to estimate the elasticity of production for physical capital, then used ordinary least squares method to estimate the solow residual, Therefore the total factors productivity, the results of the study shows that physical capital accumulation plays an important role in economic growth in the Sudan during the period of 1970-2008, while human capital comes second in terms of importance. As well as show that the growth rate of total factors productivity factors in Sudan was very low and it takes negative values in some periods, especially during 1980 and 1990. The study proved that the total factors productivity does not play an important and decisive role in the economic growth process in Sudan during the period of study.

Growth Accounting, , Total Factors Productivity (Tfp), Human Capital Index, Cobb–Douglas Production Function

Youniss S. M. E. Total Factor Productivity in Sudan Economy Based on Growth Accounting Model. Biosc.Biotech.Res.Comm. VOL 12 NO1 (Spl Issue February) 2019.

Youniss S. M. E. Total Factor Productivity in Sudan Economy Based on Growth Accounting Model. Biosc.Biotech.Res.Comm. VOL 12 NO1 (Spl Issue February) 2019. Available from: https://bit.ly/2Xl5Pyu

Introduction

Adam Smith’s productivity idea emerged through the division of labor, and the theory of growth was considered classic. The increase in productivity was linked to an increase in the share of capital, which would reach the diminishing returns. The authors of the modern theory of growth saw investment in human capital, increasing the training of workers in continuing education will necessarily increase productivity continuously.Economic growth has two sources: quantitative growth in factors of production; qualitative growth in the use of factors of production and management of the entire production process. The development of two types of productivity is usually seen as the productivity of each factor of production, often focusing on labor productivity, and the second on total productivity of production factors (TFP). Productivity is measured by the quality of input conversion to outputs or what is known as total productivity which reveal the effect of technological, cognitive and regulatory progress on increasing production, and indicate whether growth has been expanded through quantitative expansion of production inputs or qualitatively through the productivity of all its factors.

The total productivity of the factors of production is the qualitative source of economic growth (the quantitative source is the material investment and the number of workers). It reflects the technical aspect of the production process as well as the human capital. Thus, the economic growth rate cannot be sustained through cumulative increases in growth sources Quantity, because these resources are limited on the one hand and are subject to diminishing yield law on the other. Growth based on knowledge production generated by a high investment in human capital is reflected in the process of production through the process of technical progress leading to In addition, the state’s investment in health, education and scientific research is a real investment and not a subsidy. Knowledge production returns are not subject to the law of diminishing yields because of its creative and creative capabilities. For example, more than 70% of the economic growth of the last century United States to total factor productivity, which was developed by Mabat, known as the “new growth theory,” which argues that economic and social growth in the knowledge-based or commonly used economy under the name of the “knowledge economy” depends on the technological level and on the growth of this level measured by productivity measurement.

This study is an attempt to estimate the total productivity of the production factors (TFP) in the Sudanese economy in order to link economic development with both physical and human capital (as measured by the adjusted labor force) and total productivity of the factors of production. And then distribute the growth to its sources based on annual data covering the period 1970-2008, based on the principles of internal growth theory. This research consists of five sections, the first section introduction and the second section deals with the concept of total productivity of factors of production, in addition to the theoretical framework for estimating the total productivity of factors, and the framework of the expanded framework for growth accounting. The third section deals with the applied framework for estimating the total productivity of the factors of production. The fourth section is devoted to presenting and analyzing the applied results. The study also includes in its last section, the summary and the main findings and recommendations. In this study, the method of joint integration will be used to estimate the elasticity of production for capital and the method of ordinary squares to estimate the rate of growth of total productivity of production factors, in order to distribute economic growth according to its sources according to the expanded framework of growth accounting.

Theoretical And Experimental Framework

1.1 Total Factor Productivity (TFP)

Total Productive Productivity (TFP) reflects growth in the level of production that is not attributable to production inputs (physical capital, human capital) or the change in the economic yield. Efficiency and technical change are the two most important factors at this level. The total productivity growth rate is known as Solow Residual. Neither the solu- tors and total factor productivity are necessarily measured solely to measure the effect of technical progress on growth, but to explain the contribution of other factors to production inputs to output growth, On economic growth such as technical progress, innovations and others, including what affects negatively, such as disasters and crimes. The growth of total factor productivity is an important indicator of economic performance (Aiyar&Dalgaard, 2004).

1.2 The Theoretical Framework of Total Productivity of Production Factors

Several economic theories dealt with the subject of economic growth and the factors influencing its level. The classical economists linked the level of production with both capital and labor. They pointed out that increasing capital and labor leads to raising the level of production and then to growth. Influenced by the industrial revolution and the technological inventions that led to higher levels of production, the neo-classicalists added to the factors of traditional economic growth as an additional factor of technological progress. The concept of growth, as an increase in the volume of production, was defined as the Solow 1957 model. In this model, an analytical model was reached for long-term growth. With this approach, the role of technical progress has become critical and more important than the accumulation of capital. The model was based on two basic assumptions: first, the efficient use of all economic resources, the second is the decrease in capital returns and the increase in business returns. By accepting these assumptions, the model’s expectations were summarized as follows:-

- Growth is generated by an increase in the share of capital to work due to higher productivity of individuals as a result of providing them with more capital.

- The rate of growth in poor countries is rising as the return on investment in physical capital increases faster than the rich countries, which have a large stock of capital.

- The economy is likely to reach a stable state in which the new increase in capital does not lead to economic growth due to the decline in capital returns. It is possible to overcome this situation and continue to grow through external factors (exogenous) of new technological innovations (Solow, 1994, p.2-3).

The theory of external growth (Exogenous Growth) was based on the possibility of overcoming the state of stability. The continued growth, despite the diminishing returns of physical capital, depending on an external or independent factor (determined from outside the model), is the creation of new technologies that allow for higher factor efficiency.The high level of capital formation in some countries has prevented them from achieving high growth rates, and some economists, such as Barro and Baker, have maintained economic growth models based on higher productivity based on technical progress as an external factor. Therefore, growth models have been developed where technical progress is driven by economic factors that are determined from within the model (Barro&Mankiw and Martin, 1994, p. 408-409). This trend reinforced the influence of some economists & Weil, Mankiw on the role of human capital in the economic growth observed in the German experience after the Second World War, which led to the emphasis on the importance of accumulation of human capital in a similar way to the accumulation of physical capital.

Endogenous growth theory provided an example of internal growth centered on integrating the concept of human capital, such as skills and knowledge that make individuals more productive. Unlike physical capital, human capital is characterized by increasing rates of return, so that growth does not slow down when human capital accumulates. Studies in this context have focused on factors that increase the efficiency of human capital (education), for example, or raise the level of technical progress (innovations). Thus, growth is linked to the theory of internal growth, in addition to the elements of physical and human capital, The efficiency of the labor force of skills and knowledge, or increases the level of technical progress such as innovations and inventions. These factors fall under the heading of total productivity of production factors (Mankiw, Romer and Weil, 1995, p.3-5).At the practical level, there are several approaches in which overall productivity growth of factor factors can be estimated, both in terms of the Solo approach and the broader framework of growth accounting methodology:

First: Solow Approach:

Solow, 1956, published a simplified model that included an analytical framework for the causes and dynamics of economic growth and then published a second paper entitled “Technical Change and Production Function” in 1957, in which he pointed out that the overall growth rate of production, Growth of factors of production, especially physical capital, labor, technical progress or (total factor productivity). Solo used the following model:

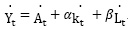

Where: :Yt the total product or total income, kt, capital stock used in production, Lt the size of the labor force involved in the production process, and the technical level At (total productivity of the factors of production).Taking into account the difference in the previous equation for time and shortness, and assuming that output returns are stable, the growth rate of output by growth sources can be divided into:

Where á and â, the production elasticities of both capital and labor and assuming the stability of the returns of the elements of production (â = 1-á), and point above the variable on the growth rate. In order of the equation above, the growth of the total productivity of the factors of production (At) or the so-called Solo condoms can be obtained as follows:

The above equation has been used by Solo himself along with many researchers such as Senhadji as well as Iradian, Senhadji.

Second: Extensive Growth Accounting Approach:

Recent studies, such as Bosworth and Collins, Senhadji, Bosworth and Susan, and Abu-Qran& Abu-Bader, have used the expanded framework of growth accounting to estimate the growth rate of total factor productivity by integrating the impact of education on economic growth with a capital appreciation Human. More specifically, the Cobb-Douglas model of fixed-size returns, including the two production factors: physical capital (K) and human capital (H), was estimated as shown in the following equation:

Where á share the physical capital K of the total product, and (á-1) share of human capital H. To estimate human capital (H), labor force (L) is weighted by coefficient (h_t), which represents the quality of education received by a worker. This rate is defined as the following:

Where st is the number of years of schooling (average year of schooling) or average years of schooling as some call it, in the age group of the labor force (15-60) years, and (r) represents the rate of return on investment in education (The rate of return to schooling. Thus, human capital is defined as:

The equation (4) is written in the same way as equation (2). After the variable L is replaced with variable (H), the output formula can be obtained by the following equation:-

As above, the point above the variable indicates its growth rate.

By rearranging equation (7), the overall factor productivity growth rate can be obtained (Senhadji, 2000, p.132-133):

In this research we will use this modern method to estimate the total productivity of the factors of production in the Sudanese economy.Despite the importance of this indicator, its assessment and calculation suffer from many difficulties. The calculation of the overall productivity growth rate of the factors of production is calculated in a safe manner; its estimation is closely related to the estimation of the other factors involved in the relationship. Solo errors include the model variables, especially those related to the various assumptions in estimating the capital stock, capital Human. In addition to the standard estimation of production elasticities for capital and labor, the constraints on volume returns in the production function and the method of calculating the growth rates of both output and physical and human capital.

Specifications And Estimation

2.1 Characterization of the model used in the study

Based on the theory of internal growth, and building the expanded framework for growth accounting used by a number of economists such as Bosworth and Collins, Senhadji Bosworth and Susan, Abu-Qran& Abu-Bader, Psacharopoulos, and Edward Denison. Assuming that the function of production we use is a form of the production of a fixed-size copodogloss which takes the following form:

![]()

Whereas

Yt: represents real GDP (Real GDP.

kt: represents the physical capital stock.

h: Equivalent (Ht Lt), which is the modified work component of

human capital index (ie, human capital per worker.]

![]()

At: Total productivity growth rate (Solow Residual).á: share the physical capital K of total output.

á: share of human capital per worker h.

(1 – á): The growth rates of the variables will then be estimated and the total productivity of the production factor will be calculated according to the following equation h:

The growth rates of the variables will then be estimated and the total productivity of the production factor will be calculated according to the following equation:

![]()

![]()

![]()

Where: (yt.) the GDP growth rate of the worker, obtained by dividing the growth rate of GDP by the economically active population (labor component.

(kt.): the rate of growth of the worker’s physical capital, and also by dividing the physical capital by the economically active population (the labor component.

The value of á will be measured according to an appropriate standard model.

![]()

2.2 Applied Results to Estimate Total Productivity of Production Factors

Before starting the estimation, it is necessary first to define the variables used in this study and to clarify the methods followed by the study in the estimate, including the element of physical capital and human capital.

3.2.1. Definition of study variables

Gross Domestic Product “GDP”

In this study, real GDP data will be used as a standard measure of economic development, available to the Sudanese Statistical Organization

Physical Capital

It is an inhuman wealth made by humans and then used in the production process.

Measurement of physical capital

Unlike human capital, which is relatively easy to measure in monetary terms, as is well known, especially in developing countries, there is no time series data on physical capital stock. Therefore, it is often used as an alternative investment-based indicator, Gross fixed capital formation.In line with the traditional traditional theory, following several previous applied studies, it was found that they were based on the estimation of physical capital and the construction of a time series of physical capital on the permanent “Perpetual Inventory Method” which includes the previous investment flows over the years with taking into account the estimation of the duration of service and the rate of consumption of fixed physical capital, according to the following equation:

Where IT represents the total investment, and ä is the depreciation rate of fixed capital (Scoppa, 2007, p.20-25). Because of data constraints, particularly in developing countries, literature usually uses total investment as an alternative to the physical capital stock (Benhabib & Spiegel, 1994, p.146). In this study, we will rely on gross fixed capital formation as an alternative to physical capital in Sudan, using data available from the Central Bureau of Statistics for the period of study. These data are available in Annex 1.We obtain the stock of physical capital per worker used in this estimate by dividing the physical capital by the economically active population (labor component).

Economically Active Population (L)

In this study, economically active population data will be used as an indicator of the labor force. The economically active population represents all individuals who are over a certain age and who can be classified as inactive or inactive in light of their basic activity (Cences, 1973, p.30). In most countries, economically active population data is available in censuses every five or ten years (available in Appendix 1). To complement the purposes of the analysis for the annual study series covering the period from 1970 to 2008, Exponential Method.

The exponential method (EM)

EM is one of the most voluntary ways of a population subject to constant composite change when change occurs at every moment and day of the year. Thus, the exponential model or Lautka model created by mathematician Malthus and developed by Lotka) In 1907, based on the Maltos model in its derivatives, named after the Lautka model. Assuming that:

r: Annual growth rate

N(t) = Pt Population per year t

N(0) = P0 Population in the base year

The exponential model or Lautka model of population estimate is written as follows:

Or formulated as follows:

Where e is a normal logarithm (2.71828), r is the exponential growth rate, t is the time difference between Pt and P0.

For example, if Pt is the year 1984, the missing year is obtained using 1983 data, namely P0 or base year, but to use this equation first, the exponential growth rate for the base year must be calculated and calculated by the following equation:

![]()

![]()

Where: Pt is 1983 and are the 1973 data, where we obtain the growth rate for the base year based on the earliest previous year where t here is 10 years. Then we obtain the data for the comparison year using equation (2). Where the above equation is used for the distressing model in estimating the population and predicting future periods. The exponential model can also be used to estimate the number of births as well as the number of deaths. This method has been used to obtain all the data that is not available for many reasons in the competent authorities. This method has been adopted in many studies and scientific researches as the best scientific method in estimating and predicting and most suitable especially in the population data because the population is increasing exponentially and formulas Nonlinear forms are the most appropriate form, especially the Lautka model.

![]()

Adapted labor component of human capital (h)

Human Cpital Index

Most studies in growth accounting focus on the role of human capital and its contribution to economic growth. Most of these studies assume that human capital measured by education is an intermediate variable. In most cases, educational standards are inadequate, Status of use of agreed levels of comparison between States. Education may also result in benefits that are sometimes not measured within growth in GDP. For example, education improves the health of the population and, moreover, improves the ability to absorb information technology that facilitates the spread of technology and innovation. Direct to improvements in GDP growth that may be associated with investment in education (Hers, 1998, p.15-23).

In the same direction, many studies found that it is difficult to detect the existence of a significant relationship of statistical significance between the change in the years of study and economic growth, and these studies have presented different explanations confirm the existence of some problems in obtaining data on educational achievement in some countries, And that it is not sufficient to measure the quality of work (because it allocates non-literate workers to zero weights), which indicates the unequal changes in the quality of work for countries that suffer From a drop in Primary levels of education. There are also many studies based on the ratio of students enrolled in schools to measure changes in education, but found that this indicator is facing a problem similar to the problems facing the investment rate as a measure of accumulation of natural capital (useful only if the case of stability or deviation to stability). In addition, many years of schooling were used in growth studies, but this method failed to measure the accumulation of human capital during the study period. Benhabib and Spiegel used average years of schooling in internal growth models where the rate of productivity growth depended on human capital formation (Susan and Bosworth, 1996, p.135-139)

As a result, many studies in a number of countries have made adjustments in the labor force, including education, age and gender. Both Psacharopoulas, Senhadji, and Susan Bosworth have introduced the labor quality index or the modified labor component of human capital as a production input in the production function, Human capital in economic growth, where they calculated the adjusted labor component index using data on years of education and return from education (this is the wage paid by the worker). This method includes determining the weights of the different levels of educational achievement based on the rate of return obtained from T Lim (Abu-Gran & Abu-Bader, 2007, p.753-755).

In this context, Edward Denison (1967) and others attempted to use estimates of the relative wage structure of workers with different levels of education to build two groups of workers across different educational levels and then calculate the human capital index using the following relationship:

Whereas:-

WJ: The total weights of wage averages for workers with different levels of education (that constitute the educational levels include uneducated workers, those with basic, secondary and university education). These weights are calculated from the wage scales issued by the competent authorities based on the grades of the different educational levels. The average wage data for the various educational stages are available in Appendix 4; Wages in any model or economic analysis to express in a simplified and concise manner the many determinants that reflect what is known as the wage structure.

|

Figure 1: The rate of growth of total productivity of the factors of production during the period from 1970-2008 |

PJ: The percentage of population with a specific educational level The percentage of educated population with primary, secondary and tertiary education is available in Annex 3.

After calculating the human capital adjusted by wages, as in the previous equation, the adjusted labor force is obtained by human capital: Ht Lt = h by multiplying the value of (H) in the economically active population (L) as a labor force (LborForce (Susan and Bosworth, 1996, p.142-144)

The adjusted human capital component is an indicator that measures the contribution of the skilled labor component and is also very good in the distribution of in-country education gains better than the human capital measured by the average years of schooling of the labor force. Several studies indicate that the adjusted worker component is very important in explaining growth in GDP and its contribution to output growth is very high in most of the countries where such studies were conducted (Hers, 1998, p.14).

Using the structure of the previous equation, we calculated the adjusted labor component of human capital or the so-called skilled labor component in Sudan during the study period (in Appendix 1) for use in the growth calculations in the study period. We calculated the relative weights of all workers The different educational levels available to us in Sudan (where levels of education differ from one country to another). Pay scales are available in the Office of Service Affairs and are divided by sectors and according to service entrances and job grades based on the level of education of the worker. As for educational attainment data or population ratio data obtained at a certain level of education, we used the data in the various censuses as well as the data available in the Paro and Li database, available as is known every five years. In order to obtain the available years, Which we explained in previous paragraphs to obtain annual data supplement for research purposes. Data on economically active population (L) are available in population censuses, which we have explained earlier.

Educational Attainment Ratio

The main problem with this indicator is that it is available only in population censuses. Since Sudan, like all other countries, has a population census every 10 years, it is difficult to obtain data on educational attainment every year. The data used in the 1973, 1983, 1993 and 2008 censuses were used in this research. In addition, the data included in the Barrowli Information Base for the educational achievement of a number of countries, including Sudan, were used to estimate the average years of study in Sudan during 1950-2010 (Barro, R. and JW. Lee (2010, p. 24-25)).

The available data on the Education attainment data were used from the Barrow database every five years, in addition to the data obtained from the Central Statistical Organization in the census years mentioned above, the unavailability of data annually, and the obtaining of data on human capital in Sudan each year. A slight interpolating adjustment in Barrow and Lee equations for human capital estimation, taking into account that this amendment will not affect the general picture of the structure of the equations and is intended to obtain annual estimates. This amendment is to use the previous Exponential Method Mentioned to To obtain annual data on educational attainment using data from various population censuses as well as data from parliaments. These data are the ones we used to estimate the human capital component adjusted above.

The Applied Framework for Estimating the Overall Productivity of the Factors of Production

This study aims to measure the total productivity of the production factors in the Sudanese economy during the period from 1970 to 2008 using the above mentioned model. The first step is to estimate the value of á (the share of physical capital of the total product or the elasticity of production for capital).

2.3.1 Estimation of the share of physical capital of the product (á)

Several attempts have been made to determine the appropriate value of the capital share of the output. Bosworth and Collins have identified the value of this. The index is typically used in many economies. This value is 0.35, while Senhadji uses 0.62 as a result of his estimate of the Kop Douglas equation with two variables: GDP for human capital component and physical capital for the human capital component. Senhadji used the method of co-integration to estimate the function of production, beginning with testing the root of unit 1 (1), and thus the possibility of a common integration of variables in the model. Secondly, to estimate the equation for the combined integration of the two variables used and to obtain value (the elasticity of production for capital).

In their study of growth sources in a number of African countries, including Sudan in the period 1960-1990, Abu-Qran and Abu-BAader used two methods to calculate the value of (á); the first method is Bosworth and Collins, the same method used by Senhadji and others (yt) and physical capital for human capital (kt). The other method is to perform regression of the two variables using the normal lower squares method. (0.37) and (0.51), in addition to a very low value of (0.07) compared to the countries of Abu-Qran and Abu-BAader. The other, when the normal regression of (yt) on kt. Abu-Qran and Abu-BAader attributed this low value to (0.07) to the fact that the role played by both human capital and total productivity of the factors of production in the Sudanese economy is exaggerated during the study period.

To estimate the value of (á) in this study we will first, using the Senhadji method, start by testing the existence of the unit root of the GDP variable, for the human capital adjusted labor component (yt = yt/ht) of the modified labor component of human capital (kt = kt/ht). Second, we will use the regression method used by Abu-Qran and Abu-BAader to estimate the value of () and compare it with the values obtained by some studies covering Sudan.

Unit Root Test

By dividing the GDP by the adjusted human capital component (yt/ht) to obtain (yt), and the physical capital for the modified labor component (adjusted human capital) (kt/ht) for (kt), after taking the natural logarithm of the variables, the following table shows the results of the unit root test for each variable.

| Table 1: The Unit Root Test | ||||||

| Variable | Model without constant or trend |

Model with constant only | Model with constant and trend |

|||

| ADF-Stat | Critical Value 1% | ADF-Stat | Critical Value 1% | ADF-Stat | Critical Value 1% | |

| Levels | -1.164 | -2.63 | -1.398 | -3.62 | -1.453 | -4.23 |

| -2.525 | -2.63 | -0.423 | -3.62 | -1.660 | -4.23 | |

| -3.556 | -2.63 | -3.63 | -3.623 | -3.662 | -4.23 | |

| First Difference | -2.1353 | -1.950 | -3.0143 | -2.945 | -2.873 | -4.23 |

It is clear from the above table that all the variables: the GDP variable for the modified work element () the physical capital variable for the modified work element (Lkt) is static in its first differences, The following is a test of joint integration between the two variables to determine whether there is a long-term equilibrium relationship between these variables using the Johansen test to estimate the value of á.

Common Integration Equation To estimate the value of

a: we will use Johansson’s co-integration method to estimate the equation of co-integration with a view to calculating a value. The following table shows the existence of a single vector of co-integration between the model variables.

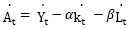

The results in the above table show the possibility of a long-term equilibrium relationship between the two variables. The variables have the expected signs and the statistical significance at a significant level of 5%. By comparing the calculated and theoretical values of the effect statistics and the maximum value, it is clear from the test of the effect and the maximum value that there is one common integration vector at the 5% significance level, summarized by the following equation:

It is clear from the above equation that the variables are statistically significant at the level of 5%, since the values between the brackets below the estimations represent the calculated value (t), and the cointegration equation shows that the value of á = 0.44 is closer to the estimates of Abu-Qran and Abu-BAader , 2007) and can be said to be a value in the long term.

The second method of estimating a value in the short term is the regression procedure of Lyt on Lkt, using the normal lower squares method. The following table shows the results of the estimation:

Initial results showed that there was a problem of autocorrelation in the model because of the lower DW value below the moral level. The table below shows the results of the evaluation before the statistical treatment. In order to solve the problem of self-correlation, the moving average method (1) After deducting the self-correlation problem, the results of the estimation in the table above show that the value of DW is at the moral level (1.4), the value of the selection factor is economically acceptable, and all the model variables are statistically significant Material Money for Human Capital (Lk), Yep The value of the coefficient, which is equal to (0.62), is approximately 0.62, which is a value in the short term. This value appears to be close to the estimates of the International Monetary Fund (IMF) IMF) by Senhadji, 2000, p.142-143, when applying the growth accounting method to estimate the growth rate of total productivity of the production factors in a number of countries in the African world (including Sudan), Europe and Asia during the period 1960-1994 and the equivalent of 0.63.Based on the values we obtained from a long and short term (0.44 and 0.62) calculation, we will estimate the overall long-run and short-term growth rate of production factors (A) .

| Table 2: The Co-integration test results | ||||

| Eigen Value | Likelihood Ratio | Critical Value (5%) | Critical Value (1%) | Hypothesized No. of CE(s) |

| 0.386144 | 18.84671 | 15.41 | 20.04 | None * |

| 0.034901 | 1.278872 | 3.76 | 6.65 | At most 1 |

2.3.2 Estimation of Total Factor Productivity Growth Rate (TFP)

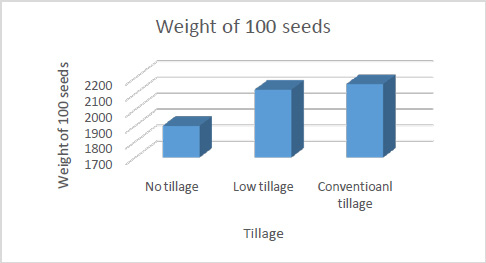

Due to the achieved values of (0.44, 0.62), which is the share of the physical capital of the gross product. In the long and short term, respectively, we can obtain the elasticity and share of the Human Capital Index Share, (0.56 and 0.38), respectively, in the long and short term, using data on the worker’s physical capital and the real GDP per worker, in addition to the adjusted labor component data in human capital, and based on the values obtained The annual rate of growth of total production factor (TFP) is obtained (Solow Residual) and (-0.066) in the long term from 1971 to 2008. If we assume that the value of á is 0.62, the annual rate of growth of the total productivity of the factors of production in the short term is (-0.092) This growth is attributed to technical progress and other factors, in contrast to physical and human capital, and it is noted that the growth rate of GDP during the period from 1971 to 2008 estimated at (0.0617) may be divided among factors of production by 1.5% for physical capital and 0.6% Of human capital, and 1.1% of total productivity of production factors (long term). (In the short term); growth itself was distributed by 2.1% for physical capital and 0.40% for human capital, and -1.5% for total productivity of the factors of production during the study period, as shown in the following table:

| Table 3: Dependent Variable: Ly | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| Lk | 0.617332 | 0.073507 | 8.398300 | 0.0000 |

| C | -4.272187 | 1.054716 | -4.050558 | 0.0003 |

| MA(1) | 0.723802 | 0.116054 | 6.236774 | 0.0000 |

| R-squared | 0.871414 | Mean dependent var | -12.85939 | |

| Adjusted R-squared | 0.864271 | S.D. dependent var | 2.674170 | |

| S.E. of regression | 0.985204 | Akaike info criterion | 2.674170 | |

| Sum squared resid | 34.94254 | Schwarz criterion | 3.009833 | |

| Log likelihood | -53.19640 | F-statistic | 121.9844 | |

| Durbin-Watson stat | 1.352281 | Prob(F-statistic) | 0.000000 | |

| Inverted MA Roots | -.72 | |||

Note: Figures in brackets are the ratio of total growth

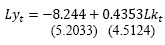

From Table 4; the paths were divided into four secondary time periods for analytical reasons only. As mentioned earlier, the growth rate of total productivity of production factors represents the contribution of factors other than physical and human capital in the process of economic growth. It is clear from the table that the computational mean of the growth rate of total productivity of the factors of production was positive during the seventies and especially during the period from 1971-1983, While in other decades, especially in the late 1980s and 1990s, which was accompanied by well-known political and social events that affected economic and social conditions, with a sharp decline in real GDP growth rate. The results of the above table show that the growth rate of total productivity of the factors of production in Sudan was low and almost negligible as it is well below 1%. The following figure shows the rate of growth of total productivity of the factors of production during the study period in the long and short term:

| Table 4: Distribution of overall growth among different factors of production (estimate of total productivity of production factors | ||||||||

|

Variables

Year |

Average Growth rate of real GDP

|

Average Growth rate of real GDP Per worker (Y/L)

|

Value of capital share

(á) |

Average Growth rate of physical capital per worker (k/L)

|

Average Growth rate of human capital per worker (h)

|

Distribution of total growth between factors of production (average growth rate multiplied by the value of á) | Amount due to TFP

|

|

| Amount due to Physical capital

(á *k) |

Amount due to Human capital

(1-á) *h |

|||||||

| 1971-1983

– |

0.170306

– |

0.1386

– |

0.44

0.62 |

0.154662

–

|

0.087299

–

|

0.0681

(49) 0.0959 (70) |

0.0489

(35) 0.0332 (24) |

0.022

(16) 0.009 (6) |

| 1984-1996

– |

0.03249

|

0.0105

– |

0.44

0.62 |

0.35256

– |

0.051226

–

|

0.1551

(15) 0.2186 (20) |

0.0287

(3) 0.0195 (2) |

-0.174

(-17) -0.228 (-21) |

| 1997-2008

–

|

0.06644

|

0.0338

– |

0.44

0.62 |

0.106897

– |

0.056726

– |

0.0470

(1.4) 0.0663 (1.96) |

0.0318

(1) 0.0216 (0.64) |

-0.045

(-1.4) -0.054 (-1.6) |

| 1971-2008

–

|

0.090359

– |

0.0617

– |

0.44

0.62 |

0.20728

– |

0.065304

– |

0.0912

(1.5) 0.1285 (2.1) |

0.0366

(0.6) 0.0248 (0.40) |

0.0661

(-1.1) -0.0916 (-1.5) |

- In view of the previous results and the graph showing the growth rate of total productivity of the factors of production in Sudan during the study period, the following can be observed:

- During the 1970s, overall productivity of production factors plays an important and positive role in economic growth and is therefore an important component of growth in that period.

- The accumulation of physical and human capital was the main element of growth in Sudan during the period from 1971 to 2008. This is evident from previous growth accounting procedures. The TFP growth rate does not appear to be a source of economic growth but rather a reduction in production efficiency.

- In the study period generally and in some secondary periods (1984-1996, 1997-2008), the growth rate of TFP is negative and leads to a decline in economic growth.

The results above agree with the findings (Senhadji, 1999, p.152-153), where the average capital share of growth was found to be greater than the average share of human capital and the average share of the total productivity growth rate of the production factor in some African countries.

Given Table 4, it is important to note the relationship between the value of á and the growth rate of TFP where we note that the increase in the value of á with the rest of the other things is the same, Of human capital or labor component adjusted by human capital (h) and total factor productivity (TFP). Collins and Bosworth, 1996, p.37), in their study of economic growth in some Asian countries, suggests that an increase in the value of á implies a decrease in the contribution of TFP to the growth process, Leads to a decline in the contribution of physical capital and an increase in the contribution of human capital, this result with the fact that physical capital is growing at a faster rate than human capital, and therefore leads to a negative correlation between the contribution of TFP and the level of á. This can be demonstrated by reference to the results we obtained in this study. For example, during the period from 1971-1983, it can be observed that an increase in á value from 0.44 to 0.62 reduced TFP contribution from 16% to 6% respectively. In the same period of time, It can be seen that the decline in the value of á from 0.62 to 0.44 leads to a decline in the contribution of physical capital from 70 to 49% and increase the human capital adequacy from 24 to 35%. In the period from 1971 to 2008, the increase in the value of á led to an increase in the contribution of physical capital and the decline in the contribution of human capital to the growth process. Also, the decline in the contribution of TFP to the production process is very significant, with the contribution of total productivity to factors of production very low sometimes , Which led to a decrease in the GDP growth rate of the worker (0.0617), which can be demonstrated by other time periods. It is therefore possible to say that the total productivity of the factors of production is not always a major factor driving economic growth, but often the contraction of economic growth.

It seems that the estimation of the total productivity growth rate of the factors obtained in this study can be compared directly with the results of other studies that estimated the rate of growth of this productivity for some regions and countries, which includes Sudan, or to cover the Sudanese economy. It should be noted here that the results of this study, which estimated the rate of growth of total productivity of factors do not contradict the results of many studies, as examples, Makdisi et al., 2002, p.35 showed in their study on growth in the MENA region During the period 1960-1998, that the overall productivity of the factors of production is not an important factor for growth in the countries of the Middle East and North Africa, and the results of this study that the contribution of total productivity of the elements were negative in most countries, or positive value, but low in some of them Sudan, Tunisia and Morocco), indicating their limited role in economic growth Financial money.

The study by Abu-Qarn and Abu-Bader, 2005, p.765-768, showed that the rate of growth of total productivity of productivity factors and their determinants for the MENA countries, Its countries have varied over the last four decades of the last century. On average, the results of Abu-Qarn and Abu-Bader in another study of the sources of economic growth in the MENA countries in 2007 indicate that the average growth rate of the total productivity of the factors of production in Sudan is -0.012 during the period 1960-1997, Contradicts our findings in this case. Where we found that the average growth rate of total productivity of the factors of production in Sudan during the period from 1971 to 2008 is (-0.066, -0.092) in the short and long term, respectively.

In their study of growth sources in the MENA countries, Abuqran and Abu Badr found that the contribution of physical capital to growth is greater than human capital. In their analysis of growth sources, the role of total factor productivity in determining economic growth is insignificant and negative in some countries. MENA (such as Sudan) where most of the growth is due to the accumulation of other factors of production. The study pointed to the relative importance of production inputs, and showed that growth is almost entirely related to the formation of physical and human capital. Other factors contribute only to a weak percentage. It is clear that among these factors is technical progress that does not seem to have a significant impact on the growth of the economy Or that its effect fades under the influence of other factors involved in the composition of the total productivity of the factors of production, and the link between them is negative and unimportant. In summary, it can be argued that during the study period, the accumulation of physical and human capital has a fairly large contribution to the growth process, while the total productivity of the factors of production or the growth rate of TFP leads to contraction in economic activity as a whole, Real GDP during the study period as well as in most other secondary periods. As most studies have found, especially in Sudan, it can be said that the total productivity of the factors of production does not play an important and decisive role in the economic growth process in Sudan

Summary and Final Results

- This study aimed at estimating the total productivity of the production factors (TFP) in Sudan, specifically during the period from 1970 to 2008. The study used gross fixed capital formation as an alternative to physical capital. In addition, TFP used the weighted human capital in the wages it earns from work Based on the level of education you get The study reached a number of results can be summarized as follows:-

- Appropriate estimation of the elasticity of production for physical capital by applying JOHN. And then used to calculate the growth rate of total productivity of the factors of production in Sudan.

- It has been showed that the growth rate of total productivity of the factors of production in Sudan was very low and takes negative values in some periods, especially during the 1980s and 1990s, and the relative elasticity of growth rates in the first case, for example, by 0.44 for physical capital and 0.56 for human capital.

- The contributions of physical capital, human capital and total productivity of the factors of production during the period 1970-2008 were distributed respectively: 1.5, 0.6 and 1.1%. The effect of the other factors of human and physical capital was small on economic development Sudan during the period from 1970 to 200 8 m. The overall productivity of production factors in the Sudanese economy does not play an important role in economic growth.

Thus, the results of the growth analysis show that the accumulation of physical capital was the main source of growth in Sudan during the period from 1970 to 2008, while the accumulation of human capital is the second most important element in contributing to growth. The weakness of human capital in the selected periods covered by the study was one of the main reasons for the significant decline in the growth rate during the 1980s and 1990s. This is not surprising because Sudan is one of the countries that suffer from a deficit in investing in education.

In conclusion, it can be said that the standard results of this study provide useful suggestions to the decision-makers in the Sudanese economy, because identifying the sources of economic growth allows the decision-maker to focus on the factors that stimulate growth, within the strategic direction of the state in diversifying the sources of income and not rely on certain revenues, After separation. The state must work to raise the level of investment in human capital, build knowledge and skills, intensify education, training and rehabilitation programs for the national workforce, encourage research and development, and ensure the right to education for all. The large gap between developed and developing countries Economic development is largely due to the formation of human capital, which requires developing countries to develop a comprehensive strategy to develop the potential of the human element in them, as the process of economic development depends greatly on the development of this element.

It should also be noted that the results obtained are subject to the variables used in this study and how they are calculated, especially with regard to the method of calculating physical capital stock, the wage-adjusted labor force (human capital), and the methodology we used to estimate the elasticity of production (A). In addition, the overall productivity growth rate of the production factors (solos) is the residuals in which the measurement and estimation errors occur. However, the overall factor productivity estimate and the Sulu condominium have been met by an enormous amount of research, studies and economic literature that have come from the usefulness of this concept, which has led us to try to apply it in a simple economic economy such as the Sudanese economy.

- In the light of the previous results, the study reached a number of proposals that may be useful to some policy makers and planners of educational and economic plans, as well as to the general researchers in this field, in order to know the shortcomings of this aspect and try to cover them,

- The need to raise the level of investment in human capital and build capacityKnowledge and skills, intensify education, training and rehabilitation programs for the national workforce, and encourage research and development spending.

- The large gap between developed and developing countries in the field of economic development is largely due to the formation of human capital, which requires developing countries to develop a comprehensive strategy to develop the potential of the human element in them, as the process of economic development depends greatly on the development of this element

- Improving the rates of return on investment in education generally requires upgrading the quality of outputs of the educational process so that it is reflected in the labor market in the form of high levels of productivity of the human element.

- There is a need to reconsider the peace of salaries and wages in Sudan in order to widen the gap between the different levels of education in a concrete way.

Researchers in this area should be cautious when using the methods of growth calculations, especially not to consider the results as merely a measure of technological progress. Furthermore, researchers must take into account that the methods of estimating the productivity growth of the total factor of production are neither a theoretical concept nor a theory of growth, because there is still no complete theory of total factor productivity, and most of these methods are valid only in countries where Has reached equilibrium in balanced growth as output grows at the rate of input growth

References

- Abu-Qarn, Aamerand Abu-Bader, Suleiman (2005) AVersus K Revisited: Evidence from Selected MENA Countries Department of Economics, Ben-Gurion University of the Negev, Beer-Sheva, Israel, MPRA Paper No. 22280. Online at:

- http://mpra.ub.uni-muenchen.de/22280/Abu-Qarn, Aamer and Abu-Bader, Suleiman (2007), Sources of Growth Revisited: Evidence from Selected MENA Countries, Ben-Gurion University of the Negev, Beer-Sheva, Israel, World Development Vol. 35, No. 5, Elsevier Ltd. Online at:

- www.elsevier.com/locate/worlddevAbdelhak Senhadji I (1999) Sources of Economic Growth: An Extensive Growth Accounting Exercise, IMF Working Paper WP/99/77, IMF, Washington, DC.

- Abdelhak Senhadji I (2000) Sources of Economic Growth: An Extensive Growth Accounting Exercise IMF Staff Papers, 47, 129–157. Central Bearu of Statistic, Sudan, Census, 1973

- Makdisi, S. Fattah, Z. and Liman, I. (2002), “Determinants of Growth in the MENA Countries”. Arab Planning Institute , Working Paper.N0. 39 ref.

- Solow R. M. (1956). “A Contribution to the Theory of Economic Growth,” Quarterly Journal of Economics, 70(1) .

- Solow, R. M. (1957). “Technical Change and Aggregate Production Function”, Review of Economics and Statistics.

- Barro, Robert J. (1997). “Determinants of Economic Growth: A Cross-Country Empirical Study”. MIT Press: Cambridge, MA.

- Bosworth B. and S. M. Collins (2003). “The Empirics of Growth: An Update”, Brookings Institution

- Iradian. G (2007). “Rapid Growth in Transition Economies: Growth Accounting Approach. IMF. WP/07/164.

- Benhabib, J. and M. Spiegel (May 1994), The Role of Human Capital in Economic Development: Evidence from Aggregate Cross-Country and Regional U.S. Data, Journal of Monetary Economics, final version.

- Lucas, Robert, (1988) ‘On the Mechanics of Economic Development,’ Journal of Monetary Economics, vol. 22.

- Barro, Robert J./Sala-i-Martin, Xavier(1995), Economic growth, New York: McGraw – Hill.

- Robert J. Barro (No date), Education and Economic Growth, Harvard University. This research has been supported, in part, by the National Science Foundation.

- Jess Benhabib and Mark M. Spiegel (December, 2002), Human Capital and Technology Diffusion, Economic Research, Federal Reserve Bank of San Francisco, 101 Market St., San Francisco.

- Robert J. Barro and Jong-Wha Lee (April 1993), International Comparisons of Educational Attainment, Working Paper No. 4349, National Bureau of Economic Research, Cambridge.

- George Psacharopoulos and Ana-Maria Arriagada (October 1986), The Educational Attainment, of the Labor Force: An International Comparison, THE World Bank, Education and Training Series, Report No. EDT38.

- Mankiw, N.G., Romer, D. and Weil, D.N.(MRW), (1992), “A contribution to the empirics of economic growth”, The Quarterly Journal of Economics, Vol.107, No. 2.

- Robert J. Barro and Jong-Wha Lee (April 2010), A New Data Set of Educational Attainment in the World, 1950–2010, Nber Working Paper Series, Working Paper 15902, 1050 Massachusetts Avenue, Cambridge, MA 02138. Online at: http://www.nber.org/papers/w15902

- Susan M. Collins and Barry P. Bosworth (1996), Economic Growth in East Asia: Accumulation Versus Assimilation, Department of Economic Studies at the Brookings Institution & Department of Economics at Georgetown University, Draft 8/28/.

- James G. MacKinnon (2010), Critical Values for Co integration Tests, (QED) Queen’s Economics Department Working Paper No. 1227. Online at: http://www.econ.queensu.ca/faculty/mackinnon/

- Gujarati, Damodar, (2004), Basic Econometrics, Fourth Edition, MaGraw-Hill New York, Companies, 2004.

- Paul Turner (2007), Testing for cointegration using the Johansen approach: Are we using the correct critical values?, Loughborough University Department of Economics, Discussion paper Series, ISSN.

- Shekhar Aiyar & Carl-Johan Dalgaard (2004), Total Factor Productivity Revisited: A Dual Approach to Development Accounting, Economic Policy Research Unit, Institute of Economics, University of Copenhagen. Online at: http://www.econ.ku.dk/epru/

- Robert M. Solow (1994), Perspectives on Growth Theory, The Journal of Economic Perspectives, Vol. 8, No. 1. Online at: http://links.jstor.org/sici?sici=0895-

- Psacharopoulos, George (1993), “Returns to Investment in Education: A Global Update,” World Development, 22, No. 9, 1325.

- Jacob Mincer (1995), Economic Development, Growth of Human Capital, and the Dynamics of the Wage Structure, Columbia University and National Bureau of Economic Research, Discussion Paper Series No. 744.

- T. W. Schultz (March 1961) “Investment in Human Capital” American Economic Review, Vol. 51, No.1.

- Bassanini, S. Scarpetta and P. Hemmings (2001), “Economic growth: the role of policies and institutions. Panel data, evidence from OECD countries”, OECD Economics Department Working Paper No. 283.

- United Nations (2007), Analysis of Performance and Assessment of growth and productivity in the ESCWA REGION, Economic and Social Commission for Western ASIA, Fifth Issue, New York.

- Johannes Hers (1998), Human capital and economic growth- a survey of the literature, CPB report.

- Denison, Edward F. (1967), Why Growth Rates Differ: Postwar Experiences in Nine Western Countries (Washington: The Brookings Institution).

- Barro, R. J., Mankiw, G. N., &Sala-i-Martin, X. (1995).Capital mobility in neoclassical models of growth, American Economic Review, No, 85.

- Psacharopoulos, G. (1985). Returns to education: a further international update and implications, Journal of Human Resources.

- Sudan Central bureau of statistics, (Cences, 1973).