Department of Healthcare and Pharmaceutical Management, Jamia Hamdard,

Corresponding author email: shibu.john14@gmail.com

Article Publishing History

Received: 09/12/2020

Accepted After Revision: 24/03/2021

Biosimilars are the subsequent adaptations of the original biologic medicines and, these are manufactured with the purpose to provide remedial effects which are similar to the original drug. In the upcoming decade, there would be an increase in the number of existing biologics going off patents which would provide an opportunity for several innovator firms to offer services, specially designed for biosimilars. The share of the biopharmaceutical sector is forecasted to undergo expansion both in the Indian and global pharmaceutical market. But the biosimilar firms face many problems in the development, clinical improvement, manufacturing, registration and product marketing. Also, fierce ongoing competition in the market obstruct the entry of new players and restrain the growth of this market. There are several challenges such as variability in structure, immunogenicity, and regulatory barriers which further impede the growth of the biosimilars market. Thus, they require separate marketing approval since they are not generic versions of biologics. Hence, they need full documentation on quality, safety and efficacy. The regulatory environment of pharmacy across the world is getting more stringent and impacting exports. Several factors, such as a discrepancy in regulations, the funds allocated for investment and the ambiguity regarding the level of market maturity attained, have served as deterrents for Indian biosimilar players to participate actively in global markets. This paper aims to highlight the biosimilars market scenario in India and worldwide. In addition to that, it also discusses the significant challenges involved with biosimilars. It also contemplates some trends that reflect the bright future for biosimilars pharmaceutical market.

Biopharma Market; Biopharmaceutical Products, Biosimilars; Pharma Export

Prakash U. G, Shibu J . Biosimilars Pharmaceutical Market in India: Current Status, Challenges and Future perspective. Biosc.Biotech.Res.Comm. 2021;14(1).

Prakash U. G, Shibu J. Biosimilars Pharmaceutical Market in India: Current Status, Challenges and Future perspective. Biosc.Biotech.Res.Comm. 2021;14(1). Available from: <a href=”https://bit.ly/3rtoNha”>https://bit.ly/3rtoNha</a>

Copyright © Prakash and Shibu This is an open access article distributed under the terms of the Creative Commons Attribution License (CC-BY) https://creativecommns.org/licenses/by/4.0/, which permits unrestricted use distribution and reproduction in any medium, provide the original author and source are credited.

INTRODUCTION

The pharmaceuticals market in India is very exclusive and has demonstrated very high potential in the last couple of decades. The sector has ranked tenth globally in terms of value and ranked third in terms of volumes. The Indian pharmaceutical market has the potential to reach USD 70 billion in future growth scenario. India’s ranking is among the 12 top biotech destinations in the world with the third position in the Asia Pacific region. India’s biotechnology segment one of the fastest-growing sectors with a turnover of $ 7 bn during the year 2015, and since then it has been growing at a rate of 16.3% annually (India Pharma, McKinsey & Company Report, 2020).

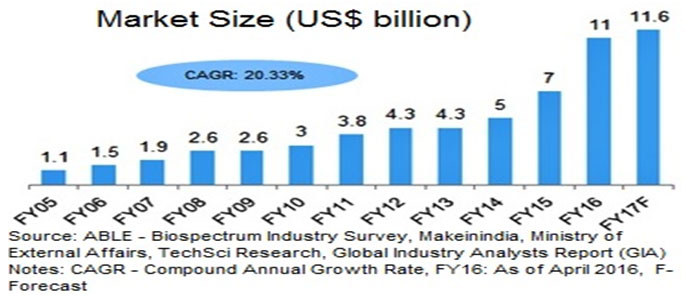

Due to the increase in patent expiries for biologic drugs, there exists a valuable opportunity for the development of more productive biopharmaceutical industry in India. Also, the remarkable success of a few recent launches has demonstrated the true potential of patented products (India Pharma Report, 2020). As compared with the previous years, the Indian biotech industry is budding at a faster speed, in FY16, it witnessed the growth of 57.14 per cent. The total industry size stood at US$ 11 billion in FY16, and it has reached to US$ 11.6 billion in FY17. This growth depends on several factors such as rising demand, rigorous research and development activities and healthy government initiatives which fast-paced the growth of this sector (Biotechnology Industry in India, 2017).

Figure 1: Global Pharma Market Size. Source-https://www.ibef.org › Industry

According to the FDA definition, biosimilars are licensed by the FDA as they are identical to the approved reference product, and shown to have no clinical difference from the biologic reference product. The first biosimilar got approval in the year 2006 in the European Union. And since then the number of approved biosimilar drugs have reached more than 700 in numbers. The biosimilar guidelines of India are in regulations with the EMA and WHO. India pharmaceutical companies are enhancing their manufacturing skills, and for clinical trials, they are working together with pharmaceutical companies worldwide. Also, due to the cost advantage of lower manufacturing cost, India has more benefit than its contesting nations which will further create a favorable scenario for the biopharmaceutical market. The Indian biosimilar market includes product segments such as insulin, G-CSF, vaccines, erythropoietin, interferon-alpha, hormones, fibrinolytic and plasma proteins.

(Table-1). Among these, insulin occupies the largest market share, followed by erythropoietin and GCSF. With the suitability of biosimilars, their demand is higher in the domestic market. These are consumed mainly as a part of remedial action and treatment of incessant illnesses such as rheumatoid joint pain, kidney problems, diabetes, tumours, CVDs, immune system illnesses, development hormone inadequacy, haematological maladies, and irresistible infections (Biosimilar and Interchangeable Products – FDA, 2017) By the year 2025, it is predicted that the international biosimilar market will reach around USD 46 billion. Now, globally there are many biosimilars in the process of manufacturing. There is immense potential for long term growth of biosimilars in established markets of Europe, Japan and the United States and consumers can pay for the same.

However, there are few challenges for biosimilars growth, such as acceptance by both doctors and patients in terms of its safety, quality, effects on health, and precision in regulatory compliance. Despite these challenges, there is an enormous capacity and high demand for biosimilar drugs in developed economies. While in the developing economies, consumers have fewer resources to pay for highly-priced biosimilar medicines. Therefore, in emerging economies, consumers have limited financial capacity and low affordability for biosimilars. Many studies have shown that the cost of biosimilar medicines is the main impediment in emerging markets. The developing world has different healthcare structure in place, and their respective authorities are now focusing on reducing the cost of biosimilars and enhancing access to medicines for their populations. However, the approval and regulatory procedures for biosimilars is also a matter of concern for both developed and developing economies (Indian pharmaceutical industry report, 2016).

RESEARCH METHODOLOGY

The main objective of this paper is to analyze the Indian biosimilar pharmaceutical market and its growth prospects. The present study discusses the biosimilar market’s current status, growth pattern, various challenges and future perspective in terms of exports. The research also focuses on strict regulatory requirements in developed and emerging markets which obstruct the entry of new participants and averting the growth of this market. This study is an outcome of extensive literature review and analysis of data from various databases like Export and Import Bank of India, IBEF, McKinsey, Company reports etc. The study also included reports of the survey conducted by multiple pharmaceutical research firms.

Review on Biosimilar Pharma Market

Indian Biosimilar Market: Biosimilar products should have resemblance with the reference product in terms of quality, stability, characterization, specification, efficacy, safety, preclinical attributes, clinical attributes, pharmacokinetics and pharmacodynamics, toxicity and immunogenic studies (Study on the Indian pharmaceutical industry, 2015). India showed its acceptance towards the concept of ‘similar biologics’ in 2000, by approving it’s first ‘similar biologic’ for a hepatitis B vaccine. In India, the development of biosimilars cost around 10-20 million USD due to regulatory procedures for their approval. And biosimilar manufacturer faces many problems in the development, clinical improvement, manufacturing, registration and product marketing in contrast with generics drugs (Rushvi P et al., 2016).

India has a huge share of the biosimilar market, and they will be expected to become a progressively vital part of the pharmaceutical ecosystem (Ray Tanmoy, 2017). In the domestic market, there are above 20 biopharmaceutical companies actively working on biosimilars development. Till date, more than 70 biosimilar products have been approved in India, and these figures are continuously increasing. Among these, more than 50 biopharmaceutical products have been permitted for marketing in India which includes monoclonal antibodies, etanercept, filgrastim, development hormones, proteins, insulins, interferons and streptokinase. And, with more than 60 biosimilars in the development pipeline, the industry is bound to establish itself in therapeutic areas such as cancer treatment, immunological disorders and diabetes. And biosimilar makers are specifically interested in leading biologics like Avastin, Humira and Levemir with recent patent expiry. Now, the Indian manufacturers are directing their concentration on more biosimilars production as many follow-on biologics are going off patent in the coming years. And it is anticipated that there will be a rise in the market share of follow-on biologics in the global biopharmaceutical market (Study on the Indian pharmaceutical industry, 2015).

Indian pharmaceutical companies have an enormous scope in the biosimilar market over other firms. Presently, India is booming as a significant contributor in the world biosimilar industry. One of the main strength India has is that it has the most significant number of USFDA approved manufacturing plants outside the US. Booming clinical trials and clinical research have added another feather in the cap of Indian pharmaceutical companies. Very low-cost infrastructures and highly educated citizens, and day by day, an increasing number of skilled forces provide the ideal combination for entering such a complex and non-established industry. However, there is a lack of specific regulations for the approval of biosimilars in India. Hence, to raise India from a complex, competitive environment and shine as a leading producer of biosimilars calls for an immediate need for the establishment of proper regulatory standards in India (Biosimilars Market Global Scenario, Market Size, Outlook and Trend, 2018).

Biosimilar products should have resemblance with the reference product in terms of quality, stability, characterization, specification, efficacy, safety, preclinical attributes, clinical attributes, pharmacokinetics and pharmacodynamics, toxicity and immunogenic studies (Study on the Indian pharmaceutical industry, 2015). India showed its acceptance towards the concept of ‘similar biologics’ in 2000, by approving it’s first ‘similar biologic’ for a hepatitis B vaccine. In India, the development of biosimilars cost around 10-20 million USD due to regulatory procedures for their approval. And biosimilar manufacturer faces many problems in the development, clinical improvement, manufacturing, registration and product marketing in contrast with generics drugs (Rushvi P et al., 2016).

India has a huge share of the biosimilar market, and they will be expected to become a progressively vital part of the pharmaceutical ecosystem (Ray Tanmoy, 2017). In the domestic market, there are above 20 biopharmaceutical companies actively working on biosimilars development. Till date, more than 70 biosimilar products have been approved in India, and these figures are continuously increasing. Among these, more than 50 biopharmaceutical products have been permitted for marketing in India which includes monoclonal antibodies, etanercept, filgrastim, development hormones, proteins, insulins, interferons and streptokinase. And, with more than 60 biosimilars in the development pipeline, the industry is bound to establish itself in therapeutic areas such as cancer treatment, immunological disorders and diabetes. And biosimilar makers are specifically interested in leading biologics like Avastin, Humira and Levemir with recent patent expiry. Now, the Indian manufacturers are directing their concentration on more biosimilars production as many follow-on biologics are going off patent in the coming years. And it is anticipated that there will be a rise in the market share of follow-on biologics in the global biopharmaceutical market (Study on the Indian pharmaceutical industry, 2015).

Indian pharmaceutical companies have an enormous scope in the biosimilar market over other firms. Presently, India is booming as a significant contributor in the world biosimilar industry. One of the main strength India has is that it has the most significant number of USFDA approved manufacturing plants outside the US. Booming clinical trials and clinical research have added another feather in the cap of Indian pharmaceutical companies. Very low-cost infrastructures and highly educated citizens, and day by day, an increasing number of skilled forces provide the ideal combination for entering such a complex and non-established industry. However, there is a lack of specific regulations for the approval of biosimilars in India. Hence, to raise India from a complex, competitive environment and shine as a leading producer of biosimilars calls for an immediate need for the establishment of proper regulatory standards in India (Biosimilars Market Global Scenario, Market Size, Outlook and Trend, 2018)

Biosimilars Market: Global Scenario: Globally, from 2017 to 2025, the biosimilars market is predicted to reach $46.0 billion, which is rising at a CAGR of 33%. The global biosimilar market has been segmented based on geography and product class. Geographically, it is segmented into Europe, Asia Pacific, North America and Rest of the world. Around 35% of the global market share is accounted for by Europe, which is the largest, followed by the Asia Pacific and North America, with 30% and 27% global market share, respectively. The rest of the world has a share of 8%. (Biosimilars Market Global Scenario, Market Size, Outlook and Trend, 2018). And the product section of biosimilars is segmented as Recombinant non-glycosylated proteins such as insulin, interferons, G-CSF, development growth hormones. Recombinant glycosylated proteins such as monoclonal antibodies, erythropoietin, follitropin. And, recombinant peptides like glucagon and calcitonin (Biosimilars Market Segmentation by Product Type, Global Demand Analysis & Opportunity, 2019).

Figure 2: Global Biosimilars Market Size and Forecast. Source-https://www.variantmarketresearch.com

Biosimilars Market: Global Scenario: Globally, from 2017 to 2025, the biosimilars market is predicted to reach $46.0 billion, which is rising at a CAGR of 33%. The global biosimilar market has been segmented based on geography and product class. Geographically, it is segmented into Europe, Asia Pacific, North America and Rest of the world. Around 35% of the global market share is accounted for by Europe, which is the largest, followed by the Asia Pacific and North America, with 30% and 27% global market share, respectively. The rest of the world has a share of 8%. (Biosimilars Market Global Scenario, Market Size, Outlook and Trend, 2018). And the product section of biosimilars is segmented as Recombinant non-glycosylated proteins such as insulin, interferons, G-CSF, development growth hormones. Recombinant glycosylated proteins such as monoclonal antibodies, erythropoietin, follitropin. And, recombinant peptides like glucagon and calcitonin (Biosimilars Market Segmentation by Product Type, Global Demand Analysis & Opportunity, 2019).

Exports of Indian Biosimilar Products: By 2030, India will become the sixth-largest market for pharmaceuticals, and it has firmly established itself in the global biopharmaceutical market. Many of the Indian pharmaceutical companies are preparing to step into the global biosimilars market. As per the report of Associated Chambers of Commerce of India’s 2017, biosimilars represent a 30% compound annual growth rate. They are worth $2.2bn out of the $32bn total Indian pharma market and are estimated to reach $40bn by the year 2030. The expiry of a range of biologic patents in the upcoming years will further aid this growth. At present, several pharmaceutical companies are starting to pursue regulated markets. In India, there is an active pipeline of biologics segment in the list of the top pharmaceutical firms named as Intas Biologicals, Biocon, Dr Reddy’s Laboratories, Zydus Cadila, Reliance Life Sciences, Lupin Pharma, Wockhardt etc (Indian biosimilar market to be worth $40 billion by 2030, 2016).

As compared to small-molecule generics, wherein cutthroat competition and suppression of prices due to numerous extrinsic and intrinsic factors hinder the profit-making potential of the market, the growth opportunities are considerably more lucrative in the biosimilar sector. The Indian biosimilar industry is approaching substantial advancements owing to a peak number of approvals in the domestic market, active commitment in semi-regulated markets and a burgeoning position in the regulated markets. This development is being driven by growing market maturity in Europe, USA and other countries, and it requires a forthcoming environment for smooth regulatory approvals and high unmet clinical need across different markets. And there are many other factors like the significance of investment in this segment, discrepancy in regulations and insecurity about the market maturity levels have aided as constraints for Indian biosimilar players to engage in regulated markets actively (Nawrat Allie, 2018).

The renowned pharmaceutical firms worldwide are establishing partnerships with Indian pharma companies which reflects the growth of a promising market of biosimilars in India. The Roche Swiss-based pharmaceutical firm moves into an agreement with Emcure, which is an Indian firm to market the drug named Biceltis for cancer treatment. Another renowned pharmaceutical firm Mylan has established a partnership with Biocon, which is Bangalore based pharmaceutical firm. Both companies now working together and have made significant development by getting approval for biosimilars in both developed markets of Europe and the US. In the year 2018, Biocon revenue growth is $120m, and this firm recorded 36% growth from there biosimilars business. And in the same year partnership of these firms, Biocon and Mylan produced a biosimilar drug named fulphila (trastuzumab) which is approved by the US FDA. This drug is shown to decrease febrile neutropenia while cancer patients go through chemotherapy.

It is the first biosimilar manufactured by an Indian pharmaceutical firm which got approval in the US. And currently, Fulphila is under review in Australia and the European Union, and many other biosimilars are going through these processes to enter the global market (Indian biosimilar market to be worth $40 billion by 2030, 2018).In the upcoming decade, there would be an increase in demand for biosimilars worldwide which will drive the biopharmaceutical industry in India. As per the report by Crisil Research, from period 2015-2021, the pharma industry in India is expected to grow at 12-14% CAGR. There are various factors which improve the growth of the biopharmaceutical sector in India, which includes the introduction of new molecules by innovators, drugs going off-patent, upsurge in ageing population and increase in the number of chronic illnesses worldwide.

With the emergence of private manufacturers, the industry landscape has undergone a drastic change, and the sector is being focused upon more. The augmentation in patent expiry for biologic drugs has birthed new opportunities for the Indian biosimilar industry. Furthermore, the domestic market highly favours the production of biosimilars due to lesser cost implications as compared to other players in the global market. This has led to improved manufacturing abilities of the Indian biopharmaceutical companies, quality standards, and well-nurtured collaborative relationships with MNCs for conducting clinical trials will further aid the robust growth of this market (Indian Biosimilars Industry-Roadmap to Actualize Global Leadership, 2018).

Challenges Faced by the Biosimilar Pharmaceutical Industry: The regulatory environment of pharmacy across the world is getting more stringent. And to compete in the global market, the Indian pharmaceutical industry needs a robust regulatory set-up in place. However, currently, the pharmaceutical sector is grappling with several issues like delays in clinical trial approvals, the new pharmaceutical pricing policy, a uniform code for sales and marketing practices, compulsory licensing, manufacturing quality, regularity uncertainty, reluctance in prescribing, complexities in the production and competition all of which need immediate attention.

Deferral of Clinical trials Approvals: These are the gold standard processes which determine the safety and effectiveness of these drugs, and they must establish before regulatory approval. India is becoming a knowledge hub for pharmacy, research and development, and clinical trials. These clinical trials are required for the growth of the pharmaceutical industry to foster cost-effective treatment for different ailments such as diarrhoea, tuberculosis, malaria, meningitis etc. to benefit from opportunities provided by biosimilar drugs. And regulatory delays in the clinical trials are severely hampering this possibility. It has disturbed the innovation curve as well as the growth of the clinical trial industry. Furthermore, issues such as ineffective regulatory oversight, need for safeguards for informed consent for vulnerable populations and compensation guidelines for patients for trial-related deaths have emerged as significant concerns. As a result, because of the mentioned limitations during clinical trials, our country is missing out on many opportunities.

Table 1. Examples of biosimilars approved in India by top 20 pharmaceutical companies dealing with biosimilar segment

| Product name | Active substance | Therapeutic area | Approval date in India | Pharmaceutical Company |

| AbcixiRel | Abciximab | Autoimmune disease | 23-Apr-13 | Reliance Life Sciences |

| Basalog | Insulin glargine | Diabetes | 2009 | Biocon |

| Biovac-B | hepatitis B vaccine | Hepatitis B | 2000 | Wockhardt |

| CanMab | Trastuzumab | Breast cancer | 23-Oct-13 | Biocon |

| Choriorel | chorionic gonadotrophin hormone | Female infertility | 22-Jun-11 | Reliance Life Sciences |

| Cresp | darbepoetin alfa | Anaemia, Cancer, Chronic kidney failure | 23-Mar-10 | Dr. Reddy’s Laboratories |

| Epofit/Erykine | epoetin alfa | Anaemia, Cancer, Chronic kidney failure | Aug-05 | Intas Pharmaceuticals |

| Exemptia | Adalimumab | Rheumatoid arthritis | 25-Sep-14 | Zydus Cadila |

| Glaritus | insulin glargine | Diabetes mellitus | Mar-09 | Wockhardt |

| Intacept | Etanercept | Ankylosing spondylitis, Psoriatic arthritis, Rheumatoid arthritis | Mar-15 | Intas Pharmaceuticals |

| MabTas | Rituximab | Lymphoma, Non-Hodgkin’s Lymphoma | 26-Feb-13 | Intas Pharmaceuticals |

| Neukine | Filgrastim | Neutropenia, Hematopoietic stem cell transplantation, Cancer | Jul-04 | Intas Pharmaceuticals |

| Neupeg | Pegfilgrastim | Cancer, Neutropenia | Aug-07 | Intas Pharmaceuticals |

| Peg-grafeel | Pegfilgrastim | Cancer, Neutropenia | 10-May-11 | Dr Reddy’s Laboratories |

| Razumab | Ranibizumab | Degenerative myopia, Diabetes complications | 19-Jun-15 | Intas Pharmaceuticals |

| Reditux | Rituximab | Leukaemia, Lymphoma, Rheumatoid arthritis | 30-Apr-07 | Dr. Reddy’s Laboratories |

| Religrast | Filgrastim | Neutropenia | 2008 | Reliance Life Sciences |

| Repoitin | Erythropoietin | Anaemia, Chronic kidney failure | 29-Nov-11 | Serum Institute of India |

| RituxiRel | Rituximab | Non-Hodgkin’s Lymphoma, Rheumatoid arthritis | 12-Feb-15 | Reliance Life Sciences |

| Wepox | epoetin alfa | Anaemia, Cancer, Chronic kidney failure | Mar-01 | Wockhardt |

| Wosulin | human insulin | Diabetes mellitus | 13-Aug-03 | Wockhardt |

| Source: CDSCO (Central Drugs Standard Control Organization) | ||||

Abbreviations

FDA: Food and Drug Administration

EMA: European Medicines Agency

WHO: World Health Organization

G-CSF: Granulocyte-colony stimulating factor

CVD: Cardiovascular Disease

USD: United States Dollar

US: United States

UK: United Kingdom

CAGR: Compound Annual Growth Rate

DPCO: Drugs Price Control Order

NLEM: National List of Essential Medicines

CBDT: Central Board of Direct Taxes

MCI: Medical Council of India

CDSCO: Central Drugs Standard Control Organization

National Pharmaceutical Pricing Policy: Pharmaceutical price controls are, in effect worldwide. The Indian government has developed the capacity of the Drugs Price Control Order (DPCO) by this policy to include all the drugs in the National List of Essential Medicines (NLEM). They have changed the formula from a cost-based method to a market-based approach to reach the maximum price limit. By this policy, the pharmaceutical firms are feeling the effects of the price controls on their top line drugs which will have a negative impact in short course. However, the adoption of refined strategic measures will negate this impact to a large extent in the long term.

There is one issue which has severely impacted the pharmaceutical industry is the timeline for the implementation of DPCO. The pharmaceutical industry felt that the government did not provide sufficient time for implementing the new packaging and labelling with the revised prices. There is no clarity regarding location, when and where packaging and labelling exercises could be undertaken. Due to this, some pharma companies go to court to get an extension while others who couldn’t go in time are still suffering. This problem can be avoided through the right consultation and by giving adequate time to the firms for the implementation of the revised prices.

Uniformity in sales and marketing practices protocol: The Department of Pharma has given guidelines on uniformity in sales and marketing practices protocol. These guidelines applied to all pharmaceutical firms to streamline marketing efforts and prevent corruption. But the Department of Pharma guidelines differs from the MCI guidelines on sales and marketing practices. And the tax authorities use the Central Board of Direct Taxes (CBDT) circular based on MCI guidelines to decide on permitted sales and marketing expenses. So, due to different benchmarks between the directions of Department of Pharma and MCI. There is an increased demand for clarity, both from the perspective of the tax authorities and the pharmaceutical industry.

Compulsory licensing: The pharmaceutical industry is already following strict rules and regulations on manufacturing and quality practices for drug development both in domestic and international markets. The blanket practice of compulsory licensing will destabilize both the Indian as well as foreign biopharmaceutical companies. There should be an equilibrium between the need for the affordability of drugs and intellectual property protection. The intention of the government to ensure the availability of patented medicines at a reasonable price is noble, but there are other ways of achieving the same go

Manufacturing quality: The Indian pharmaceutical industry is efficient, which is making affordable medicines not only for the Indian market but also exporting these drugs to the world. The increasing confidence of foreign markets for the drugs manufactured in India is vital. For that, the authorities need to set quality standards as par with the global standards through appropriate legislation. Effective enforcement and compliance with these standards also need to be monitored.

During last year, the pharmaceutical export from India to the US increased to 32%, and India has become the biggest supplier of medicines to the US. Now Indian pharma firms are drawing more massive FDA scrutiny for manufacturing and quality compliance. For India to continue exporting to the foreign markets, the manufacturers will have to step up their quality and curate manufacturing compliance programs which are in line with the regulations. Addressing the above challenges, holistically will strengthen the sector, which constitutes a significant part of the Indian economy.

Regulatory Uncertainty: Unpredictability and inconsistency exist in the regulatory scenario governing biosimilars. In the year 2010, the Biosimilars Act, also recognized as the Biologics Price Competition and Innovation Act, was passed to set a standard for the approval process for biosimilar medicines. The act defined the pathway for approval and the timeline for biosimilars. The act also authorizes the FDA to undertake identical measures. This act has given six guidance documents to explain provisions of the Biosimilars Act, which strengthened the standards for some restrictions and added new restrictions.

The Reluctance in Prescribing: Biosimilar drugs are produced using a living system, or genetics which significantly affects the safety and efficacy of the therapeutic molecules. Even a minor change in the formulation or process can change the final product drastically as compared to generic drugs. Slight changes in the manufacture of biosimilar medicinal products can affect the efficiency and efficacy of therapeutic molecules to a very great extent. Physicians have been reluctant to adopt biosimilars unless these agents show useful clinical data. So, many healthcare providers are unwilling to prescribe biosimilar products, which pose a major challenge to the growth of the market.

Complexities in Production: The cost indulges in developing biosimilar drug is higher than generic drugs. Also, biosimilars production is a complex process which involves exact copying the structure of the original biologic. Thus, the biosimilar manufacturing incurs a high cost, time and risk in comparison to generic drugs. And this production cost is passed on to the consumers in terms of higher prices.

High Competition: The competition with the reference products threatens the position of biosimilars in the market. The discounts in this sector stem from rebates and service contracts for branded biologics, which is not the case in generic drugs that are often generously discounted, thus reducing the appeal of biosimilars. In case of complicated or chronic biologic treatments, the demonstration of the benefits of trading in biosimilars and convincing the stakeholders could consume more time. The biopharmaceutical companies must devise suitable strategies to mitigate the risk emanating from the above-discussed challenges for continual and compliant growth over the next decade (Indian pharmaceutical industry: Challenges and Prospects, 2016).

RESULTS AND DISCUSSION

FUTURE PERSPECTIVE:The growth of global biopharmaceutical market is influenced by various factors such as desired results of clinical trials, emerging pressure to diminish healthcare expenditure, increase in the incidence rate of chronic diseases, and rising demand of biosimilars for different ailments such as rheumatoid arthritis, blood disorders, cancer etc. The share of the biopharmaceutical sector is forecasted to undergo expansion both in the Indian and global pharmaceutical market. In the upcoming decade, there would be an upsurge in the number of existing biological drugs going off-patent, which leads to a rise in demand for biosimilar drugs. However, certain challenges such as manufacturing complexities, novel strategies by biologic drug manufacturers, costs, stringent regulatory requirements in developed and developing countries will hinder the entry of new players and restrict the development of this market. By looking at the trends in the most optimistic scenario, it is predicted that in India by the year 2030, the biosimilar pharmaceutical market worldwide will be of $240 billion, and the domestic market reach will be around $40 billion.

Therefore, the Indian biopharmaceutical firms can attain specialization in the biosimilar sector and further propagate it to established markets. Thus, making India a leading contributor towards this segment and this necessitates the existence of a specified and streamlined process so that the Indian manufactured products can be at par with the globally accepted standards, and more export opportunities can be harnessed. These measures will adequately supply India with ammunition to compete with other developed countries in terms of regulatory aspects and export of biosimilars. Thus, it is essential to foster the vibrant industry landscape and support the biosimilar pharmaceutical industry in real value realization. It is pertinent to impart necessary information and accurate inventory to all the participants. So, they can be well prepared to contest in commercial encounters both in domestic as well as international markets.

Conflict of Interest: The authors as named Gyan Prakash Ujalayan, Shibu John declares that there is no conflict of interest.

REFERENCES

Biosimilar and Interchangeable Products – FDA (2017). Available from: https://www.fda.gov/drugs/biosimilars/biosimilar-and-interchangeable-products

Biosimilars Market Global Scenario, Market Size, Outlook and Trend. (2018). Available from:https://www.variantmarketresearch.com/report-categories/…/biosimilars-market

Biosimilars Market Segmentation by Product Type, Global Demand Analysis & Opportunity. (2019). Available from: https://www.researchnester.com/

Biotechnology industry in India – Market Share, Reports, Growth (2017). Available from: https://www.ibef.org

Indian biosimilar market to be worth $40 billion by 2030. (2016). Available from: https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/indian-biosimilars-market-may-reach-40-bn-by-2030-report/articleshow/54717517.cms?from=mdr

Indian Biosimilars Industry-Roadmap to Actualize Global Leadership. Confederation of Indian Industry & Sathguru Management Consultants. (2018). Available from: https://www.sathguru.com

Indian Pharmaceuticals Industry Analysis (2017). Available from: https:// www.ibef.org

Indian pharmaceutical industry: Challenges and Prospects. Export-Import Bank of India. (2016). Available from: https://www.eximbankindia.in/Assets/Dynamic/PDF/Publication-Resources/…/55file.pdf

India Pharma 2020: Propelling access and acceptance, realizing true potential. McKinsey& Company; (2018). Available from: https://www.mckinsey.com

Nawrat Allie. Expanding from generics to biosimilars in India. (2018). Available from: https://www.pharmaceutical-technology.com

Ray Tanmoy. (2017) Bio-Pharmaceutical Industry in India: Market Size, Challenges, and Opportunities and Rise of the Start-ups in the Indian Biotechnology Space. Available from: https://biomedicalcounselor.wordpress.com

Rushvi P et al. (2016) Biosimilars: An Emerging Market Opportunities in India. Pharmaceut Reg Affairs. Vol 165 No 5. DOI:10.4172/2167-7689.

Study on the Indian pharmaceutical industry. Export-Import Bank of India (2015). Available from:https://www.eximbankindia.in/Assets/Dynamic/PDF/Publication…/55file.pdf