Department of Healthcare and Pharmaceutical Management Jamia Hamdard, New Delhi, India

Corresponding author email: shibu.john14@gmail.com

Article Publishing History

Received: 19/10/2020

Accepted After Revision: 10/12/2020

As historically evident, a healthcare crisis like COVID-19 can have widespread repercussions. Under preparedness has rendered the global economy unfunctional, with businesses shutting down, massive job losses and supply chains disrupted. The current study is conceived in the backdrop of Covid19 and its impact on consumer behavior pattern particularly in the context of social, buying, traveling and spending behavior. The data was collected by circulating an online questionnaire among a selected sample based on convenient and snowball sampling technique. The data largely analyzed using quantitative techniques. Results were explained through pie-charts, bar graphs and Chi-square test in Microsoft Excel and SPSS-Version 24, respectively. The study finding shows that respondents are resorted to limited spending only. Sectors like aviation, hospitality, luxury goods and services were not given priority. These sectors have faced the brunt of reduced incomes and exhausted savings. Financial insecurity has rendered the market tight-fisted and apprehensive about new brands, whereas increased demand of domestically-made products, FMCGs and focus on hygiene and emergency preparedness have birthed opportunities for businesses to leverage and emerge as organizations people can trust.

COVID-19, Consumer Behavior, Buying Behavior, Economic Impact, Post-Pandemic Marketplace

Aqeel U, John S, Rasool I, Kukreja A. Analyzing the Impact of Economic Shock Due to Covid19 on Consumer Behavior Pattern: A Cross Sectional Study conducted in Delhi & National Capital Region. Biosc.Biotech.Res.Comm. 2020;13(4).

Aqeel U, John S, Rasool I, Kukreja A. Analyzing the Impact of Economic Shock Due to Covid19 on Consumer Behavior Pattern: A Cross Sectional Study conducted in Delhi & National Capital Region. Biosc.Biotech.Res.Comm. 2020;13(4). Available from: <a href=”https://bit.ly/2JY2boI”>https://bit.ly/2JY2boI</a>

Copyright © Aqeel et al., This is an Open Access Article distributed under the Terms of the Creative Commons Attribution License (CC-BY) https://creativecommons.org/licenses/by/4.0/, which permits unrestricted use distribution and reproduction in any medium, provide the original author and source are credited.

INTRODUCTION

The COVID-19 pandemic emerged from China’s Wuhan district in late 2019 and followed varying patterns of emergence, infection and spread globally. As of September 29, 2020, it has reached 213 countries with more than 33 million confirmed cases and over 1 million deaths, challenging the health systems, economies and communities globally. Without any vaccines or appropriate medical interventions except symptomatic ones, most countries resorted to non-pharmaceutical interventions (NPIs), such as lockdowns, social distancing, closure of academic institutions and non-essential services/businesses, cancelling public gatherings and levying stringent travel bans (Stefan et al. 2020). These measures have given a new face to the global economy. The changes seen in the ways of living, thinking, buying and travelling are multi-faceted and the economic downturn is apparent in all sectors, but the service sector is most likely to suffer huge losses and job cuts. (McKinsey, 2020).

Businesses and economic functions have been rendered inoperative in the wake of the preventive measures. The global recession is speculated to be more catastrophic than the Great Depression of 1929 and the Stock Market Crash of 2008-09. A 13-32% drop in worldwide trade is expected to occur in 2020 attributing to COVID-19 (Azevedo, 2020). India has to simultaneously deal with the COVID-19 crisis, its already staggering GDP growth and a 45-year unemployment high. FY-2019 observed a GDP growth of only 4.7%, lowest since 2013 and also a 5.2% fall in industrial output in the eight core output sectors, reportedly the worst in 14 years (Rastogi, 2020).

The outbreak has made the market tight-fisted and the consumers apprehensive (Carufel, 2020). Crumbling SCM practices and unplanned trade restrictions have caused business closures and jobs/salary cuts in all industries, which have altered consumers’ personal financing behavior, entailing reduced consumption or spending, resulting into lesser flow of money into the economy. With the lockdown in force, the expenditure on fuel, dining and socializing has been reduced and the consumer spending behavior in the recently ‘unlocked’ states is cautious and household spending patterns have been majorly altered. The work-from-home culture has favored the use of online shopping platforms, widening the reach of e-commerce in both metros and non-metros. People have become increasingly aware of healthcare and hygiene practices, which have now become a force of habit.Worldwide cancellations of Mass Gatherings (MGs) since early March, have rendered the travel and tourism, entertainment and hospitality industries inoperative. Even though the restrictions are now being eased, the consumers are apprehensive. It has become crucial for retail businesses to re-evaluate and restructure their operations in accordance with the new market trends and constantly changing the what’s and how’s of buying behavior (Carufel, 2020).

The economic impact of the outbreak is becoming increasingly evident. The International Monetary Fund has estimated the global economy to shrink by around 3% in FY-2020 and a collapse is being feared even in the US, China, UK, Germany, France and Japan (Lawder, 2020 and Mahar, 2020). As per the Economic Survey of 2018-19, around 93% of the total workforce is informal and the Periodic Labor Force Survey (PLFS) 2017-18, reported that 6.1% Of India’s Labor Force, which comprises around 17.8% of young people aged 15-29 years, is unemployed. Acuite Ratings & Research estimates the lockdown to cost $4.5 billion to the Indian economy per day and Barclay’s research pegs the output loss at $26 billion per week with zero GDP growth for India in FY 2020. Health security and global changes are determined by understanding how a disease outbreak impacts travel patterns and practices worldwide (Burkle, 2006). Travel parameters are integral determinants of disease epidemiology and disease surveillance mechanism development (Hon, 2013 & Khan, et al. 2009). The World Travel and Tourism Council estimates the impact of travel restrictions to be the most severe in the Asian continent. Globally, around 50 million jobs in this sector are at stake, and negative growth of 25% is being estimated (Faus, 2020).

The Indian Association of Tour Operators (IATO) estimates losses amounting up to INR 8500 crores in the hotel, travel and aviation sectors (Suri, 2020). Spending on road transport comprised more than 90% of the total travel expenditure and bus services were the most widely used in both rural and urban India, as reported in 2016 by the National Survey Sample Office (NSSO) (UTIP, 2020). The travel advisory for the pandemic suggests the use of only personal vehicles for all transportation purposes and avoiding all public transport (Saxena,2020). Consequently, a research conducted by IIT-Hyderabad and Bombay, reported that around 93% of respondents prefer personal vehicles over public transport (Pandey, 2020).In the consumer goods market, reduced demand will be superseded by delayed demand. The companies and suppliers working on thin working-capital margins will be gravely impacted (Mckinsey, 2020). The virus spread, social distancing implications and increased awareness about COVID-19 have considerably impacted the social behavior of the people. Several prominent MGs have been cancelled or postponed along with various sports events including the Union of European Football Associations Euro 2020 football championship, the Formula 1 Grand Prix in China, the Six Nations rugby championship in Italy and Ireland and others. The Islamic pilgrimages of Umrah and Hajj in Saudi Arabia will be organized with stringent rules like tests for visitors, restrictions for people older than 65 and isolation of the visitors afterwards (McCloskey et al., 2020).

The 2009 outbreak of H1N1 virus, observed the emergence and application of the concept of ‘mass gathering medicine’(Memish, 2019) owing to which, less than 100 pilgrims were diagnosed with Influenza A H1N1 09, including five fatalities, after Hajj ended on November 30, as the Saudi MoH reported (Haworth, Rashid, & Booy, 2020). Influenza outbreaks have been observed throughout the history of sporting and music events such as the 2002 Winter Olympics in Salt Lake City, UT, the USA, and music festivals in 2009 in Belgium, Serbia, and Hungary, and also at the World Youth Day in Sydney, NSW, Australia, in July 2008 (McCloskey, 2014). Kumbh Mela being one of the most significant religious mass gathering events (MGE) reportedly attracted a record of over 24 crore national and foreign visitors in 2019 (John, 2020).

Such mass gatherings have been observed as a public health threat in past instances, attributing to the spread of various respiratory, faeco-oral, vector-borne, zoonotic, gastrointestinal, genitourinary and other infections (Sridhar, Gautret and Brouqui, 2015). Several popular entertainment events like the Oscars, the Cannes movie festival and movie releases along with award shows have been either cancelled or postponed. The Events and Entertainment Management Association (EEMA) is seeking aid to support the 60 million employees associated with it. The INR 183 billion Indian film industry is also estimated to face a loss of INR 200-250 crores over the next few months (Suri, 2020). Acuite Ratings and Research has attributed the disease to cause around 50 per cent reduction in multiplex footfalls in the upcoming months in the metros and Tier II cities (Shekhar, 2020).

Various studies have shown that densely populated fitness centers, gymnasiums and sports facilities could cause more infections. An instance of more than 100 people being infected with the virus occurred in a Zumba training workshop in South Korea (DeMarco, 2020). The Coronavirus has staggered the functioning of the fitness industry risking shutting down of smaller gyms and substantial revenue losses for larger chains leading to unemployment of thousands of fitness trainers and support staff (Economic Times , 2020a). In response to the virus, the household spending underwent a sharp increase initially in the retail segment, credit card purchases, food items and other FMCGs; later followed by a sharp decrease (Baker et al. 2020). Findings from another primary study reported that income and wealth losses averaging around $5,293 and $33,482, respectively were faced by almost half the respondents. Aggregate consumer spending observed a drop of 31 log percentage points with the travel and apparel sectors being hit the worst (Coibion, 2020).

The US observed a 5% hike in the personal savings rate in March which stood at 8% in February (Brancaccio, Wrenn, and Soderstrom, 2020). In the initial days of the crisis, a 50% increase in household spending was observed, with a 7.5% increase just in the grocery segment. A subsequent decline in spending followed the imposition of restrictions (Bhatia, 2020).The buying is more focused on essential goods and is mainly occurring through digital means and from local brands and providers (Accenture report, 2020). A study titled “Changes to the general lifestyle due to COVID-19 in selected countries 2020”, conducted on 2,137 respondents, was published by Alexander Kunst. The results of that study have been tabulated in Table 1 ( Kunst, 2020).

Table 1. The results of the study published by Alexnader Kunst (2020)

| QUESTIONS | GERMANY | UNITED KINGDOM | UNITED STATES |

| STAYED AT HOME MORE | 71% | 84% | 77% |

| WASHED HANDS MORE | 70% | 75% | 73% |

| APPLIED SOCIAL DISTANCING | 61% | 78% | 69% |

| WEAR PROTECTIVE FACE MASKS OUTSIDE | 52% | 20% | 66% |

| AVOIDED PUBLIC PLACES LIKE BARS AND RESTAURANTS | 58% | 67% | 65% |

| GONE TO THE SHOPS LESS | 59% | 71% | 62% |

| TRAVELLED LESS | 51% | 69% | 56% |

| CANCELLED PLANS WITH FAMILY OR FRIENDS | 54% | 62% | 53% |

| SHOPPED ONLINE MORE | 30% | 46% | 52% |

| CLEANED YOUR HOUSE MORE | 20% | 40% | 43% |

| AVOIDED PUBLIC TRANSPORT | 50% | 60% | 36% |

| AVOIDED CERTAIN SHOPPING TIMES | 37% | 43% | 35% |

| WORKED FROM HOME | 22% | 28% | 30% |

| I HAVE NOT MADE ANY CHANGES TO MY LIFESTYLE | 5% | 2% | 5% |

Increased spending on survival goods and services has shifted the focus from non-essential and luxury goods (Singh, 2020). ‘Panic Buying’ induced because of increased consumer awareness about COVID-19 and a sense of fear regarding product shortages, was responsible for a hike in the sales of various healthcare and hygiene products like sanitizers, masks and household products like groceries, personal care products and others. As reported by Nielsen, a market research firm, the sales of hygiene products and medical-grade masks have increased by more than 300%, and some grocery products like shelf-stable milk and milk substitutes, with longer shelf lives, have reported a dollar growth of more than 300%. (Nielsen Report, 2020).

COVID-19 has proved to be even more disruptive than technology towards our working, shopping and communication mannerisms. A study conducted in the Chinese context by Mckinsey points towards increased consumer alignment with digital modes of shopping for household and personal care items. Other market surveys have revealed that around 3/4th of Internet users across China and South-east Asia have avoided crowded public places because of the virus scare (Reddy, 2020). E-Commerce platforms have seen a worldwide increase in their popularity and have considerably facilitated the entire shopping experience. The most massive increase in e-commerce has been reported in Vietnam, where 57% of consumers are switching to online purchases. India (55%), China (50%) and Italy (31%) have also seen widespread purchasing digitization, as recently reported by Ipsos (Clapp, 2020).

These platforms have also been encountered by some safety concerns (Meyer, 2020). However, the World Health Organization cleared up the confusion by deeming it safe to receive packages from locations where COVID-19 cases have been reported.The luxury goods industry has faced significant losses in the wake of the pandemic with companies like Vogue Business projecting losses amounting to around $10 billion for this segment in the FY 2020 (Biondi, 2020). The data collected from PropTiger.com shows a 26% decline in the housing sales in nine major Indian cities for the first quarter of 2020. Prospective real estate customers are highly likely to postpone their purchase decision as they await financial stability (Singh, 2020). Automobile companies like Maruti Suzuki, Honda, Toyota and Tata Motors, are estimating a rise in demand owing to the social distancing norms, fear of virus spread and reduced preference towards public transport (Economic times, 2020b).

The association of the virus with China has rendered the Indian marketplace hostile and Indian consumers unwelcoming towards Chinese products. In 2018-19, China exported well above 60% of electronic products and components and over 80% of antibiotics. Several Indian market segments are bound to feel the impact if Chinese goods are boycotted, putting thousands of jobs at stake and risking huge losses. (Martin, 2020).Assessing the purchase patterns of the consumers reveals that grocery is the most bought item accounting for 19% of the sales, followed by household products and personal care items at 13%, healthcare products at 12% and beauty products at 7%. 30% of respondents have reduced their frequency of shopping in stores (Carufel, 2020). As the pandemic advances, studies conducted in the Indian context have revealed that as high as 87.2% of Indians have shown a considerable increase in concern towards personal hygiene, attributing to behavioral changes. Health and hygiene brands have developed large-scale campaigns and strategies to spread awareness on the importance of cleanliness (Das, 2020).

METHODOLOGY

Research Question and Objectives: Idea of studying consumer behavior pattern, in the Covid19 era, was conceived after reviewing many research articles published on the impact of Covid19. Accordingly, the authors have structured the proposed study to understand in depth whether COVID-19 has impacted the consumer behavior and how it has influenced general lifestyle of the population. Also, the study proposes to find the association between COVID-19 and consumer behavior concerning certain sectors. To address the above research question, following research objectives were formulated: To investigate the effect of COVID-19 on the general lifestyles of the people.To examine the relationship between COVID-19 and Consumer Behavior pattern.

Hypothesis: Four hypotheses were also formulated to understand the impact of COVID-19 on the consumer behavior pattern. These hypotheses were developed with respect to buying behavior in certain specific sectors. H01: There is no relation between COVID-19 and Social Behavior.Ha1: There is a relation between COVID-19 and Social Behavior.H02: There is no relation between COVID-19 and Travelling Behavior.Ha2: There is a relation between COVID-19 and Travelling Behavior.H03: There is no relation between COVID-19 and Spending Behavior.Ha3: There is a relation between COVID-19 and Spending Behavior.H04: There is no relation between COVID-19 and Buying Behavior.Ha2: There is a relation between COVID-19 and Buying Behavior.

Study Design and Data Analysis plan: The proposed study is both descriptive and analytical in nature. Quantitative method is used in the study and primary data were collected through online structured questionnaire. Questionnaire was developed, having 29 questions, related to various aspects such as demography, social behavior, travelling behavior, buying behavior, income, savings and spending behavior of the respondents etc. Questionnaire was prepared using google forms and sent to nearly 500 individuals digitally. Samples were identified based on convenient and snowball sampling technique. Total 323 respondents sent their complete responses. Majority of the samples were from Delhi and NCR region.

Data were analyzed using Microsoft Excel, and the results were presented using absolute figures and percentages of total participants. MS-Excel spreadsheet was used to derive the pie charts and the bar graphs for analysis. Quantitative analysis is done using Microsoft Excel and SPSS-Version 24. The data were divided into four sections – Social Behavior, Travelling Behavior, Buying Behavior and Spending Behavior. The Chi-Square test has been used as a statistical tool to test the relationship and to draw some inferences at a 95% confidence interval on the data collected. A Chi-square test for independence compares two variables in a contingency table to see whether there is a statistically significant relationship between categorical variables. It gives a p-value which indicates whether the test results are significant or not. A p-value that is less than or equal to the significance level (< 0.05) indicates that there is sufficient evidence to conclude that the observed distribution is not the same as the expected distribution. It can be concluded that a relationship exists between the categorical variables.

RESULTS AND DISCUSSION

Table 2. Demographic characteristics of participants in the study.

| DEMOGRAPHIC INDICATOR | NUMBER | PERCENTAGE |

| GENDER | ||

| MALE

FEMALE |

237

86 |

73.4

26.6 |

| AGE GROUP | ||

| ≤18 YEARS

19-30 31-45 46-59 MORE THAN 60 YEARS |

1

183 118 17 4 |

0.3

56.7 36.5 5.3 1.2 |

| MARITAL STATUS | ||

| DIVORCED

MARRIED UNMARRIED |

1

147 175 |

0.3

45.5 54.2 |

| EDUCATIONAL QUALIFICATION | ||

| HIGHER SECONDARY

GRADUATION POST-GRADUATION DOCTORATE |

14

102 177 30 |

4.3

31.6 54.8 9.3 |

| OCCUPATION | ||

| GOVERNMENT JOB

PRIVATE JOB BUSINESS OWNER HOUSEWIFE |

43

221 43 16 |

13.3

68.4 13.3 5 |

| MONTHLY INCOME DIVISION | ||

| RS. 15000 AND LESS

RS. 16000-30000 RS. 31000-50000 RS. 51000-80000 MORE THAN RS. 80000 |

55

69 116 62 21 |

17

22 36 19 6 |

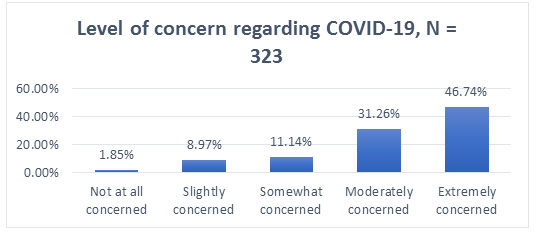

The demographic details of the participants have been given in the Table 2. The proportion of male respondents in the survey was found to be higher than females. Out of the total respondents, 73% were male. Majority of the participants were from the age group 19-30, i.e., 57% of the total respondents of the survey (Figure4.2). 95% of the participants were married. As far as the educational qualification is concerned, 44% of the respondents in the sample population were graduates, and 33% had doctorate degrees. 69% of the total respondents were employed in the private sector, and the participation of the respondents having monthly income 31000-50000 was higher than other income groups. Majority of respondents were found to show a high level of concern towards COVID-19. Around 48% of the survey population regarded the threat of the virus to be high (Figure 1).

Figure 1: Level of concern regarding COVID-19, as reported by respondents

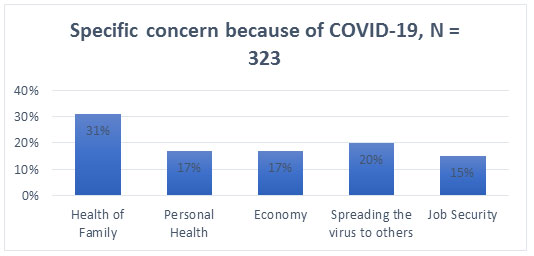

The respondents were specifically concerned about the health of their family members. The risk of spreading the virus to others and causing infections, was also one of the major concerns (Figure 2).

Figure 2: Specific concerns of the respondents regarding COVID-19

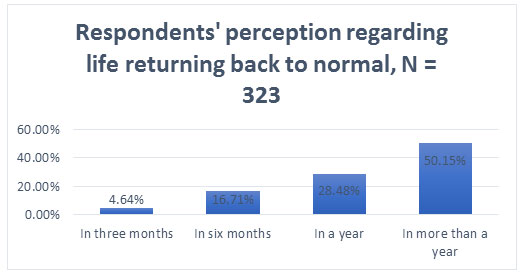

More than 50% of the sample population was of the view that in India, the disruption in normal lives of the people due to COVID-19 would take more than one year to recover and return to normal (Figure 3).

Figure 3: In how long life will return back to normal in India, as per respondents’ perception

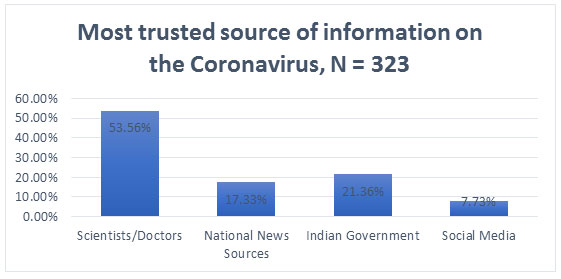

The most trusted source of information about COVID-19 among the sample population were Scientists/Doctors, followed by the Indian government, then National news sources. Social media was considered the least trustable source of information (Figure 4). Table 3 describes the impact of COVID-19 on the Social Behavior of the respondents where, 62% of the sample population was found to be staying at home and strongly unwilling to go out for public gatherings. Most of the respondents decreased their social interactions to protect themselves from COVID-19. Further, majority of the people surveyed would prefer not to go out for movies as well as for living concerts for some time even if COVID-19 is over.

Figure 4: Various Sources of Information regarding COVID-19 as reported by respondents

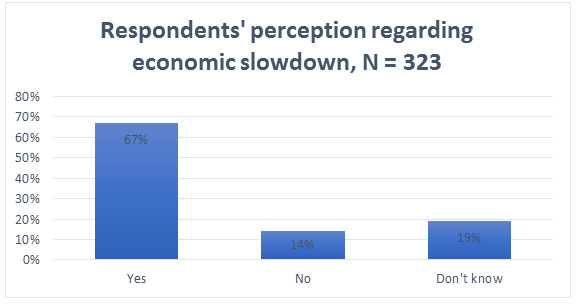

Table 4 describes the impact of COVID-19 on the Travelling Behavior of the respondents Majority of the people have reduced their frequency of travelling and have only travelled sometimes during the outbreak. Further, the people were mostly found to be travelling for business purposes. Before COVID-19, the most preferred mode of the travel was private vehicles followed by public transport. For outstation travel, air transport was the second to last preferred mode of travel for the respondents . Even after COVID-19 majority of the people would be inclined towards using private vehicles, while the preference towards other modes has considerably decreased and rail transport was the least preferred. Table 5 describes the impact of COVID-19 on the Spending Behavior of the respondents Almost 67% of the people said they feel that a recession or economic slowdown is inevitable (Figure 5). The uncertainty of the current situation has drastically altered the patterns of buying and spending among the consumers. 91% of the people have limited their expenditure due to COVID-19. Further, almost 61% of the population has increased their savings by up to 20% during the lockdown.

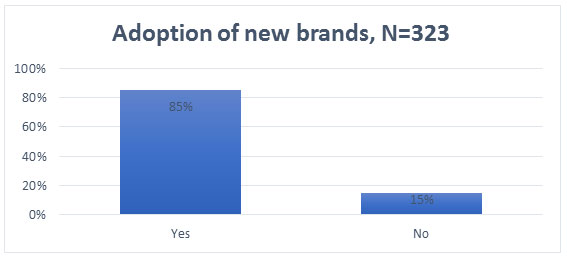

Figure 5: Respondents’ perception regarding the occurrence of an economic slowdown.

Table 6 describes the impact of COVID-19 on the Buying Behavior of the respondents Almost 81% of the population was affirmative regarding the impact of news about COVID-19 on the products they buy and admitted that it had impacted their buying behavior. The attitude of the people regarding Chinese-made products did not see much variations. Most of the people were not at all concerned about sourcing ingredients/parts from China while some of them were extremely concerned. 41% of the people were found to be likely to stop buying products from China. However, 37% of people did not share any opinion related to buying products from China. During the lockdown, the frequency of in-person shopping from the local shop decreased in around more than half of the population. Further, the research has found that the frequency of shopping from online platforms has decreased due to COVID-19. 61% of the population was concerned about the reliable fashion of delivery through online shopping. 85% of the population said that during the lockdown, they did not try new brands. (Figure 6).

Figure 6: Adoption of new brands during lockdown, as reported by the respondents

It is apparent from the Table 6 that people have bought grocery more than other products. People trying to stock up groceries due to the pandemic indicates ‘panic-buying’ which has led to an increase in the demand for these products as compared to the other categories, and also product shortages. The purchase of hand sanitizers saw an increase, followed by the purchase of disposable masks due to the pandemic. The majority of respondents, i.e., 158, said that they could not predict when they are going to buy big-ticket items while 88 respondents said that after a year, they would consider purchasing luxurious goods.

Hypotheses testing and Interpretation: The proposed study was conducted to know the behavioral impact of the pandemic on the people. And to study the relationship between identified variables, four hypotheses were made. These hypotheses were tested using Chi-square. Result of each hypothesis were described below H01: There is no relation between COVID-19 and Social Behavior. Ha1: There is a relation between COVID-19 and Social Behavior.

To test the hypothesis cross tabulation is used between the following variables:

- Concern about Covid-19 and Social behavior.

Table 3. The hypothesis (H01) was tested, and the results are given in.

| SOCIAL BEHAVIOR | |||

| STATEMENT | FREQUENCY (N) | PERCENTAGE (%) | P-VALUE* |

| ARE YOU STILL WILLING TO GO OUT FOR PUBLIC GATHERING EVENTS/ACTIVITIES? | |||

| EXTREMELY WILLING | 4 | 1.2 | 0.00 |

| MODERATELY WILLING | 7 | 2.2 | |

| NOT AT ALL WILLING | 203 | 62.8 | |

| SLIGHTLY WILLING | 80 | 24.8 | |

| SOMEWHAT WILLING | 29 | 9 | |

| WHAT ACTIVITIES/EVENTS WILL YOU CUT BACK, WHICH INVOLVE PUBLIC GATHERINGS ONCE COVID-19 IS OVER? | |||

| FITNESS CLASSES/ GYMNASIUM | 55 | 17 | 0.00 |

| SPORTING EVENTS | 52 | 16 | |

| LIVE CONCERT | 71 | 22 | |

| MOVIES | 74 | 23 | |

| RESTAURANTS/BARS | 71 | 22 | |

It is apparent from Table 3 that there is a significant association between COVID-19 and the Social Behavior as the p-value is less than the significant value 0.05. 62% of the respondents are not willing at all to go out to public places due to COVID-19. The reason could also be associated with increased concern and awareness among the people about the virus. A total of 151 respondents are extremely concerned about the virus spread, and 33% of the sample population are doctorate holders, whereas 44% are graduates. So, it can be concluded that the respondents are well educated and are thus reluctant to join public gatherings knowing the consequences of the virus. The outcome of the results suggested to accept the alternate hypothesis, i.e., there is an association between the COVID-19 and Social Behavior and failed to accept the null hypothesis. H02: There is no relation between COVID-19 and Travelling Behavior.Ha2: There is a relation between COVID-19 and Travelling Behavior.

To test the hypothesis cross tabulation is used between the following variables:

Concern about covid-19 and Travelling behavior.

Table 4. The above hypothesis (H02) was tested to know the impact of COVID-19 on travelling, and the results are encapsulated in.

| TRAVELLING BEHAVIOR | |||

| STATEMENT | FREQUENCY (N) | PERCENTAGE (%) | P-VALUE* |

| HOW FREQUENTLY DO YOU TRAVEL?

ALWAYS OFTEN SOMETIMES RARELY NEVER |

51 72 135 61 4 |

15.8 22.2 41.8 18.9 1.2 |

0.000 |

| PURPOSE OF TRAVEL?

BUSINESS HOLIDAY MEETING RELATIVES OTHER |

116 61 65 81 |

35.9 18.9 20.1 25.1 |

0.000 |

| WHAT WAS YOUR PREFERRED MODE OF TRAVEL (BEFORE SPREAD OF CORONAVIRUS/ BEFORE LOCKDOWN) *

AIR RAIL PUBLIC TRANSPORTATION (BUSES/METRO) OWN VEHICLE |

75 41 88 119 |

23.2 12.7 27.2 36.8 |

0.341 |

| WHAT WILL BE YOUR PREFERRED MODE OF TRAVEL (AFTER CORONAVIRUS SPREAD/ AFTER LOCKDOWN) *

AIR RAIL PUBLIC TRANSPORTATION (BUSES/METRO) OWN VEHICLE |

56 15 38 214 |

17.3 4.6 11.8 66.3 |

0.000 |

It is evident from the above table 4 that the frequency of travelers was affected significantly with a p-value less than 0.05. Moreover, the nation-wide ban on travel significantly impacted business-related travel. The preferred mode of transport after the lockdown changed and was statistically significant with a p-value less than 0.05 at CI of 95%, because people prefer to travel in their private vehicles rather than in public, air and rail transport. The researcher found that there was a significant impact on the travelling behavior of the people due to COVID-19. In this view, the null hypothesis was not accepted, i.e., there is no association between COVID-19 and Travelling Behavior.H03: There is no relation between COVID-19 and Spending Behavior.Ha3: There is a relation between COVID-19 and Spending Behavior. To test the hypothesis cross tabulation is used between the following variables: Concern about covid-19 and Spending behavior.

Table 5. The hypothesis (H03) was tested, and results are précised in.

| SPENDING BEHAVIOR | |||

| STATEMENT | FREQUENCY (N) | PERCENTAGE (%) | P-VALUE* |

| HAVE YOU STARTED LIMITING YOUR SPENDING?

YES NO |

295 28 |

91.3 8.7 |

0.000 |

| YOUR SAVING AS COMPARED WITH 2019 HAS INCREASED BY (%)

0 – 20 21 – 40 41 – 60 61 – 80 MORE THAN 81 |

206 68 35 12 2 |

63.8 21.1 10.8 3.7 0.6 |

0.005 |

It is quite evident from the above results that COVID-19 is associated with the spending Behavior of the respondents with p-values less than 0.05. 36% of respondents of this survey belong to the income group ranging from 31,000 to 50,000. So, any change in the market will affect their buying and spending behavior. Consumers have started to limit their spending and have also increased their savings in contrast to 2019. The uncertainty accompanying the pandemic has urged people to spend less and save more.H04: There is no relation between COVID-19 and Buying Behavior.Ha4: There is a relation between COVID-19 and Buying Behavior. To test the hypothesis cross tabulation is used between the following variables: Concern about covid-19 and buying behavior.

Table 6. The above hypothesis (H04) was tested, and the results are summarized in.

| BUYING BEHAVIOR | |||

| STATEMENT | FREQUENCY (N) | PERCENTAGE (%) | P-VALUE* |

| IS THE NEWS ABOUT CORONAVIRUS IS IMPACTING WHAT PRODUCTS YOU ARE PURCHASING?

YES NO |

262 61 |

81.1 18.9 |

0.000 |

| ARE YOU CONCERNED ABOUT INDIAN/FOREIGN BRANDS SOURCING INGREDIENTS/PARTS FROM CHINA?

NOT AT ALL CONCERNED SLIGHTLY CONCERNED SOMEWHAT CONCERNED MODERATELY CONCERNED EXTREMELY CONCERNED

|

79 72 59 47 66 |

24.4 22.3 18.3 14.6 20.4 |

0.163 |

| WILL, YOU STOP BUYING PRODUCTS FROM CHINA?

YES NO CAN’T SAY |

133 71 119 |

41.2 22.0 36.8 |

0.903 |

| DURING THE LOCKDOWN YOUR FREQUENCY OF IN-PERSON SHOPPING FROM THE LOCAL SHOP HAS

INCREASED DECREASED NOT CHANGED |

173 116 34 |

53.6 35.9 10.5 |

0.000 |

| DURING THE LOCKDOWN YOUR FREQUENCY OF SHOPPING FROM ONLINE PLATFORMS HAS

INCREASED DECREASED NOT CHANGED |

71 182 70 |

22.0 56.3 21.7 |

0.000 |

| ARE YOU CONCERNED ABOUT THE RELIABLE FASHION OF DELIVERY THROUGH ONLINE SHOPPING

YES NO |

196 127 |

60.7 39.3 |

0.000 |

| WHAT PRODUCTS ARE YOU BUYING MORE? (CAN SELECT MORE THAN ONE OPTION)

GROCERY HOUSEHOLD PRODUCTS PERSONAL CARE PRODUCTS HEALTHCARE PRODUCTS (OTC MEDICINES ETC.) |

135 81 39 68 |

42 25 12 21 |

0.000 |

| HOW MANY ITEMS HAD YOU PURCHASED SINCE YOU CAME TO KNOW ABOUT COVID-19? (CAN TICK MORE THAN ONE OPTION)

HAND SANITIZER DISINFECTANT WIPES ANTIBACTERIAL SOAP DISPOSABLE FACE MASKS DISPOSABLE GLOVES |

97 35 55 84 52 |

30 11 17 26 16 |

0.000 |

| WHEN WOULD YOU CONSIDER PURCHASING BIG-TICKET ITEMS (HOMES, CARS, TRIPS, LUXURY GOODS)?

0 – 3 MONTHS 4 – 6 MONTHS 7 – 12 MONTHS AFTER A YEAR CAN’T PREDICT |

16 23 38 88 158 |

5.0 7.1 11.8 27.2 48.9 |

0.000 |

It was found that the impact of news on the buying behavior of people was significant as the p-value 0.000 is less than the significant value of 0.05. Similarly, the frequency of shopping from local shops in person was significantly increased with a p-value less than 0.05 due to all the malls and big grocery stores being closed during the lockdown. Further, there was a significant decline in online shopping with a p-value less than 0.05 due to the lockdown and people were also reluctant to buy things online because they were not sure about whether or not the delivery personnel were following the suggested health and hygiene practices. There was a statistically significant increase in the purchase of products and grocery topped the list among all the categories. Hygiene practices were more discussed due to COVID-19 and to prevent its spread. As it is evident from the Chi-square results, there is a significant increase in the purchase of hygiene products with a p-value less than 0.05. The majority of the respondents belong to the middle-income group, which is also an influencing factor for buying behavior. The results of the data are in support of the alternate hypothesis (Ha4), so the researcher failed to accept the null hypothesis, i.e., there is no association between the COVID-19 and Buying Behavior.

Whenever or wherever a disease outbreak has occurred, it has led to chaos and adverse economic repercussions (Jarus, 2020). The occurrence and spread of disease, whether the Spanish Flu of 1918 or the HIV/AIDS pandemic of the 1980s, have always led to economic downfall worldwide. The COVID-19 pandemic is no different. The negative impact on the population and widespread economic ramifications were the inevitable results of the enforcement of lockdowns and travel restrictions. Every sector was impacted in some way. People lost financial stability, job security and their savings were gravely impacted. The dynamics of consumer buying behavior, lifestyle and travel as well as social behavior have been altered drastically. An analysis of the collected data shows that COVID-19 has changed the world as we know it. Various sectors targeted in the study are significantly associated with the virus and maintain a direct correlation with the overall behavior of the people. Majority of them are avoiding social gatherings, and the frequency of travelling has also decreased. The fear of recession and economic downfall has significantly affected the spending behavior of the respondents, with an increased focus on savings and limited spending. The demand for many luxurious goods and services have taken maximum hit and people are not willing to buy things that are not in absolute necessity.

This study has aided in spotting various business opportunities that likely to change for short term or long-term post COVID-19. The behavioral changes that affected demand creation were studied in the proposed study. The opportunity to turn this change into a profit-making venture for healthcare and hygiene products is enormous, with hiked demand estimated to be long term or even permanent. Results of the study, to a larger extent supported the outcome of literature studied for the paper. Consumers resorted to bulk buying or panic buying fueled by their fear of the lack of resources and shortcomings of the domestic supply chain, creating a new direct link between consumers and wholesale channels. With an increasing number of shoppers becoming interested in knowing the source of the products, they are buying it is safe to assume that the crisis may ignite a long-term trend in the popularity of domestically made products, leading to a resurgence for ‘Made in India’ products. The need for ‘germ-free’ homes and a mandate for ‘safe’ public places, will lead to budding ‘Sanitizing’ businesses pan India. Companies or brands associated with in-home entertainment have seen a massive demand-surge during the pandemic. An increase in domestic tourism and ‘rental car boom’ is likely, owing to air travel restrictions and lack of confidence in public transport. The aviation and hospitality sectors will need to reposition their businesses to cater to the needs of a changing market.In times of crisis, consumers are often known to gravitate towards traditional ways of buying goods and opting for services, perhaps driven by the perception of being in control and limiting their spending.

The current spike in e-commerce and online services may be short-lived, and the post-pandemic market could see an increased inclination towards ‘offline’ shopping. Supply chain transparency is now of paramount importance pertaining to the fragility of the global supply chain made apparent by COVID-19. It is integral for companies to improve their SCM by focusing extensively on various data-driven tools, emergency-proofing and risk-preparedness. Consumers are more likely to lean back on the brands they trust, and newer brands might be faced with apprehension in a tight-fisted market. In such situations, brands should morph into reliable sources of information to the consumers, along with initiating modifications in their business models and strategies. The market demand needs to be deduced by listening to the consumers and finding new solutions that they can trust.

Competing Interests: The authors have no competing interests.

Funding: This research did not receive any special grant from the funding agencies in the public, commercial, or not-for-profit sectors.

REFERENCES

Accenture Report On COVID-19 Will Permanently Change Consumer Behaviour. Accessed And Retrieved As On May 9, 2020: Https://Www.Accenture.Com/Us-En/Insights/Consumer-Goods-Services/Coronavirus-Consumer-Behaviour-Research

Acuite Ratings , (2020). Impact Of COVID-19 On GDP Growth Of FY21. Accessed And Retrieved As On April 3, 2020: Https://Www.Acuite.In/Sector-Alert-Impact-Of-COVID-19-On-GDP.Htm

Azevêdo, DZ, (2020). Trade Set To Plunge As COVID-19 Pandemic Upends Global Economy. Retrieved And Accessed As On April 22, 2020 : Https://Www.Wto.Org/English/News_E/Pres20_E/Pr855_E.Htm

Brancaccio, D., Wrenn, C M., And Soderstrom, E., (2020). How The COVID-19 Economy Is Changing Americans’ Spending Habits. Accessed And Retrieved As On May 19, 2020: Https://Www.Marketplace.Org/2020/05/11/Covid-19-Economy-Consumer-Spending-Habits-Savings/

Bhatia, S., (2020). How Covid-19 Hit US Household Spending. Accessed And Retrieved As On May 10, 2020: Https://Www.Livemint.Com/News/World/How-Covid-19-Hit-Us-Household-Spending-11588620489929.Html

Biondi, A., (2020). Coronavirus Could Cause A €40 Billion Decline In Luxury Sales In 2020. Accessed And Retrieved As On March 1, 2020:Https://Www.Voguebusiness.Com/Companies/Coronavirus-Luxury-Brands-Impact-Sales-Altagamma

Burkle, M.Jr, (2006). Globalisation And Disasters: Issues Of Public Health, State Capacity And Political Action. Journal Of International Affairs, 59(2), 231–265.

Carufel, R., (2020) Coronavirus Crisis’ Consumer Impact—New Data On Purchase Decisions And Behaviours. Accessed And Retrieved As On April 2, 2020:Https://Www.Agilitypr.Com/Pr-News/Public-Relations/Coronavirus-Crisis-Consumer-Impact-New-Data-On-Purchase-Decisions-And-Behaviours/

Clapp, R., (2020). E-Commerce Shopping More Frequent Because Of COVID-19. Accessed And Retrieved As On April 28, 2020:Https://Www.Warc.Com/Content/Paywall/Article/WARC-DATAPOINTS/Ecommerce_Shopping_More_Frequent_Because_Of_COVID19/132077/

Coibion, O., Y. Gorodnichenko, And M. Weber (2020a, May). The Cost Of The Covid-19 Crisis: Lockdowns, Macroeconomic Expectations, And Consumer Spending. Working Paper 27141, National Bureau Of Economic Research.

Das, P., (2020). Lifestyle Changes During Covid-19. Accessed And Retrieved As On April 25, 2020: Https://Timesofindia.Indiatimes.Com/Blogs/Melange/Lifestyle-Changes-During-Covid-19/

Demarco, E., (2020). Indoor, High-Intensity Fitness Classes May Help Spread The Coronavirus. Accessed And Retriedved As On May 25, 2020: Https://Www.Sciencenews.Org/Article/Covid-19-Coronavirus-Indoor-High-Intensity-Fitness-Classes

Economic Times, (2020a). Coronavirus: Fitness Industry Crumbles As Gyms Shut Down, Livelihoods Hit. Accessed And Retrieved As On April 1, 2020:Https://Economictimes.Indiatimes.Com/News/Politics-And-Nation/Coronavirus-Fitness-Industry-Crumbles-As-Gyms-Shut-Down-Livelihoods-Hit/Articleshow/74794523.Cms?From=Mdr

Economic Times, 2020b. COVID-19 Impact: Major Automakers See Demand For Personal Vehicles Going Up. Accessed And Retrieved As On May 29, 2020:Https://Economictimes.Indiatimes.Com/Industry/Auto/Auto-News/Covid-19-Impact-Major-Automakers-See-Demand-For-Personal-Vehicles-Going-Up/Articleshow/75938828.Cms?From=Mdr

Faus, J., (2020). This Is How Coronavirus Could Affect The Travel And Tourism Industry. Accessed And Retreived As On April 25, 2020: Https://Www.Weforum.Org/Agenda/2020/03/World-Travel-Coronavirus-Covid19-Jobs-Pandemic-Tourism-Aviation/

Hon, L.(2013). Severe Respiratory Syndromes: Travel History Matters. Travel Medicine And Infectious Disease, 11(5), 285–287

Jani K, Dhotre D, Bandal J, Et Al. World’s Largest Mass Bathing Event Influences The Bacterial Communities Of Godavari, A Holy River Of India. Microbial Ecology. 2018 Oct;76(3):706-718.

John, K., (2020). A Record Over 24 Crore People Visited Kumbh-2019, More Than Total Tourists In UP In 2014-17. Accessed And Retrieved As On May 25, 2020: Https://Www.Hindustantimes.Com/India-News/A-Record-Over-24-Crore-People-Visited-Kumbh-2019-More-Than-Total-Tourists-In-Up-In-2014-17/Story-9uncpmhbpnbj11clntiyqp.Html#:~:Text=The%20Kumbh%202019%20visitors%20included,Lakh%20foreign%20tourists%2C%20arriving%20here.&Text=During%20the%2049%2Dday%20Kumbh,People%20visited%20the%20Sangam%20city

Khan, , Arino, J., Hu, W., Raposo, P., Sears, J., Calderon, F., Heidebrecht, C., Macdonald, M., Liauw, J., Chan, A., & Gardam, M.(2009). Spread Of A Novel Influenza A (H1N1) Virus Via Global Airline Transportation. New England Journal Of Medicine, 361(2), 212–214.

Kunst, A., (2020). Thinking About Your Everyday Life, Since The COVID-19 / Coronavirus Pandemic, Have You Made Any Changes To Your General Lifestyle? Accessed And Retrieved As On June 15, 2020: Https://Www.Statista.Com/Statistics/1105960/Changes-To-The-General-Lifestyle-Due-To-Covid-19-In-Selected-Countries/

Lawder, D., (2020). Global Economy In 2020 On Track For Sharpest Downturn Since 1930s: IMF. Accessed And Fretreived As On April 17, 2020: Https://Www.Reuters.Com/Article/Us-Imf-Worldbank-Outlook/Global-Economy-In-2020-On-Track-For-Sharpest-Downturn-Since-1930s-Imf-Iduskcn21w1ma

Mahar, I., (2020). Impact Of Covid-19 On Global Economy Structure. Accessed And Retreived As On April 25, 2020: Https://Moderndiplomacy.Eu/2020/04/22/Impact-Of-Covid-19-On-Global-Economy-Structure/

Martin, C., (2020). COVID-19 Impact | Boycott Chinese Products: Social Media Campaign In India Gathers Steam. Accessed And Retrieved As On May 1, 2020:Https://Www.Moneycontrol.Com/News/Trends/Covid-19-Impact-Boycott-Chinese-Products-Social-Media-Campaign-In-India-Gathers-Steam-5111641.Html

Mckinsey Report On COVID-19: Briefing Note. Accessed And Retrieved As On June 30, 2020: Https://Www.Mckinsey.Com/Business-Functions/Risk/Our-Insights/Covid-19-Implications-For-Business

Meyer, S., (2020). Understanding The COVID-19 Effect On Online Shopping Behaviour. Accessed And Retrieved As On April 16, 2020: Https://Www.Bigcommerce.Com/Blog/Covid-19-Ecommerce/#Product-Categories-Shifting-During-Covid-19

Mishra, S., (2020). Impact Of Coronavirus On Indian Real Estate. Accessed And Retrieved As On June 25, 2020: Https://Housing.Com/News/Impact-Of-Coronavirus-On-Indian-Real-Estate/

Mccloskey, B., Zumla, A., Ippolito, G., Blumberg, L., Arbon, P., Cicero, A., Endericks, T., Lim, P.L., Borodina, M., 2020. Mass Gathering Events And Reducing Further Global Spread Of COVID-19: A Political And Public Health Dilemma. The Lancet.

Mccloskey B, Endericks T, Catchpole M, Zambon M, Mclauchlin J, Shetty N, Et Al. 375 London 2012 Olympic And Paralympic Games: Public Health Surveillance And 376 Epidemiology. Lancet 2014;383:2083–9.

Memish, Z. A., Steffen, R., White, P., Dar, O., Azhar, E. I., Sharma, A., & Zumla, A. (2019). Mass Gatherings Medicine: Public Health Issues Arising From Mass Gathering Religious And Sporting Events. The Lancet, 393(10185), 2073–2084.

Nielsen Report (2020) On “PANDEMIC PANTRIES” PRESSURE SUPPLY CHAIN AMID COVID-19 FEARS. Accessed And Retrieved As On March 1, 2020: Https://Www.Nielsen.Com/Us/En/Insights/Article/2020/Nielsen-Investigation-Pandemic-Pantries-Pressure-Supply-Chain-Amidst-Covid-19-Fears/

Owen Jarus, O., (2020). 20 Of The Worst Epidemics And Pandemics In History. Accessed And Retrieved As On March 22, 2020:Https://Www.Livescience.Com/Worst-Epidemics-And-Pandemics-In-History.Html

Pandey, A., (2020). Awareness Of Covid-19 Higher In India’s Tier-1 Cities, Says Study By Iits. Accessed And Retrieved As On April 5, 2020:Https://Www.Indiatoday.In/India/Story/Awareness-Of-Covid-19-Higher-In-India-S-Tier-1-Cities-Says-Study-By-Iits-1662733-2020-04-03

Rashid H, Shafi S, Haworth E, Et Al. Viral Respiratory Infections At The Hajj: Comparison Between UK And Saudi Pilgrims. Clin Microbiol Infect 2008; 14:569–574.

Rastogi, S., (2020). The New Normal: Analysis Of COVID-19 Impact On The Indian Economy. Accessed And Retrieved As On May 15, 2020: Https://Blog.Smallcase.Com/The-New-Normal-Analysis-Of-Covid-19-On-Indian-Businesses-Sectors-And-The-Economy/

Reddy, A., (2020). Covid-19 Impact: Consumers Move More Towards Digital. Accessed And Retrieved As On April 28, 2020: Https://Www.Thehindubusinessline.Com/Opinion/Covid-19-Impact-Consumers-Move-More-Towards-Digital/Article31337127.Ece

Saxena, A., (2020). Lockdown: Commuting During The COVID-19 Outbreak. Accessed And Retrieved As On June 1, 2020:Https://Www.Cars24.Com/Blog/Lockdown-Commuting-During-The-Covid-19-Outbreak/

Scott R. Baker & R.A. Farrokhnia & Steffen Meyer & Michaela Pagel & Constantine Yannelis, 2020. “How Does Household Spending Respond To An Epidemic? Consumption During The 2020 COVID-19 Pandemic,” NBER Working Papers26949, National Bureau Of Economic Research, Inc.

Shekhar, M., (2020). Covid-19 Impact Explained: How India’s Film Industry Got Hit And Is Preparing For A New Normal. Accessed And Retrieved As On May 1, 2020:Https://Indianexpress.Com/Article/Explained/Explained-How-Will-Coronavirus-Impact-Entertainment-Industry-6370412/

Singh, S., (2020). Impact Of Covid-19 On Consumer Behaviour. Accessed And Retrieved As On May 15, 2020:Https://Timesofindia.Indiatimes.Com/Readersblog/Marketing-Swan/Impact-Of-Covid-19-On-Consumer-Behaviour-19164/

Singh, A R., (2016). E-Auctions: What Benefits Does It Hold, For Buyers And Builders? Accessed And Retrieved As On May 21 2020: Https://Housing.Com/News/E-Auctions-Benefits-Hold-Buyers-Builders/

Sridhar S, P. Gautret, P. Brouqui A., Comprehensive Review Of The Kumbh Mela: Identifying Risks For Spread Of Infectious Diseases. International Journal Of Infectious Diseases. Clin Microbiol Infect, 21 (2015), Pp. 128-133

Stefan Gössling, Daniel Scott & C. Michael Hall (2020): Pandemics, Tourism And Global Change: A Rapid Assessment Of COVID-19, Journal Of Sustainable Tourism,

Suri, I., (2020). Impact Of COVID-19 On Indian Economy And Road Ahead For Corporate Sector. Accessed And Retrieved As On May 10, 2020: Http://Bwdisrupt.Businessworld.In/Article/Impact-Of-COVID-19-On-Indian-Economy-And-Road-Ahead-For-Corporate-Sector-/30-04-2020-190322/

UTIP Report On BUSES ARE MOST PREFERRED MODE OF TRANSPORT IN INDIA. Accessed And Retrieved As On May 27, 2020: Https://India.Uitp.Org/Articles/Buses-Are-Key-Mode-Of-Transport

WHO (2020)Public Health For Mass Gatherings: Key Considerations.

Https://Www.Who.Int/Ihr/Publications/WHO_HSE_GCR_2015.5/En/. Accessed As On March 17, 2020

WHO (2020) Key Planning Recommendations For Mass Gatherings In The Context Of The Current COVID-19 Outbreak. The Link Is Given Below:

Https://Apps.Who.Int/Iris/Bitstream/Handle/10665/331004/WHO-2019-Ncov-Poemassgathering-2020.1-Eng.Pdf?Sequence=1&Isallowed=Y Accessed As On April 22, 2020.